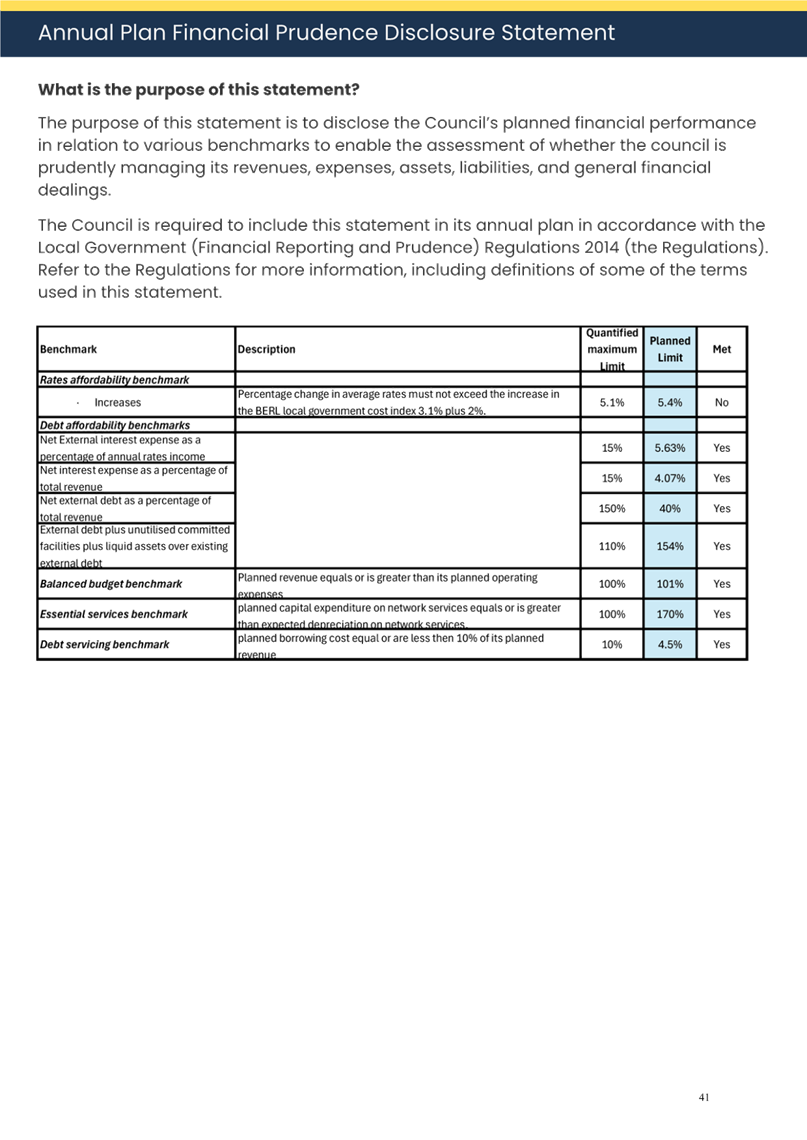

|

Ordinary

Council Meeting Agenda

|

11

June 2025

|

8 Reports

8.1 Adoption

of Draft Annual Plan 2025/26

1. Purpose

For the Council to

consider the adoption of the draft Annual Plan 2025/26 and resolution to set

rates for the year ending 30 June 2026.

2. Significance

The

matters for decision in this report are not considered to be of significance

under the Significance and Engagement Policy.

3. Background

Council

produces a Long-Term Plan (LTP) every three years. The LTP is subject to the

Special Consultative Procedure as set out in the Local Government Act 2002

(LGA). Annual Plans are produced for Years 2 and 3 of an LTP, confirming

forecasts and considering any changes that have occurred since the LTP was

adopted.

Council

adopted its most recent LTP in 2024, covering the period 2024-2034. The Draft

2025/26 Annual Plan (Attachment 1) is year 2 of this LTP.

4. Discussion

4.1 Updating Data for Year 2 of the

2024-34 LTP

While

preparing forecast budgets for 2025/26, potential changes or variations to the

LTP were identified and discussed informally with Council. These changes

reflect the latest data available, changes to some assumptions, and better cost

estimates together providing a more accurate starting position for the 2025/26

Annual Plan.

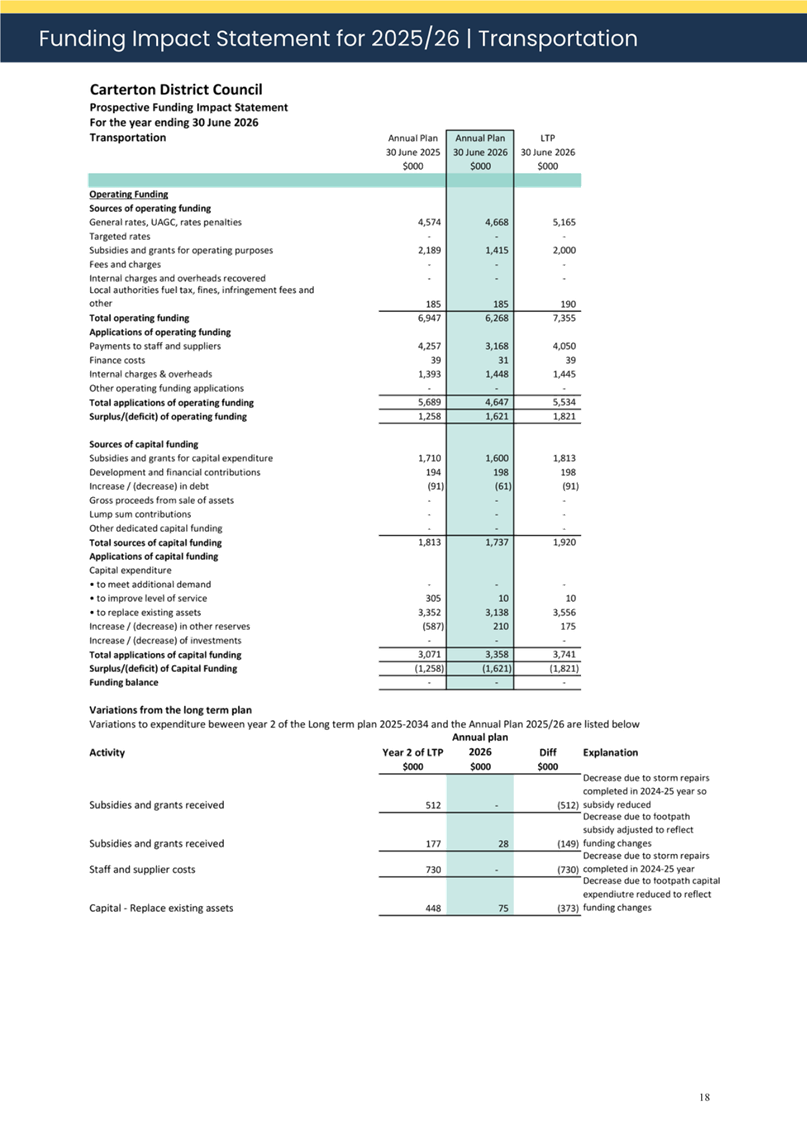

Changes

made in the 2025/26 Annual Plan when compared to the forecasts in the 2024-34

Long-Term Plan, include:

· Resetting the base from the Annual Report 2024.

· Recalculating the opening balances on loans, reserves and capital

programmes.

· Aligning Transportation budgets to the latest NZTA National Roading

programme.

· Critically reviewing all operating costs for savings opportunities.

· Removing inflation assumptions.

· Updating insurance and interest rate assumptions with the latest

data.

· Inclusion of newly legislated Government Levies for the Water

Services Regulator - Taumata Arowai.

These

variations have been assessed against Council’s Significance and

Engagement Policy. None of these variations have been assessed as significant,

and there are no changes to levels of service being provided by the Council

from year 2 of the LTP. As a result, Council resolved not to formally consult

on the draft annual plan.

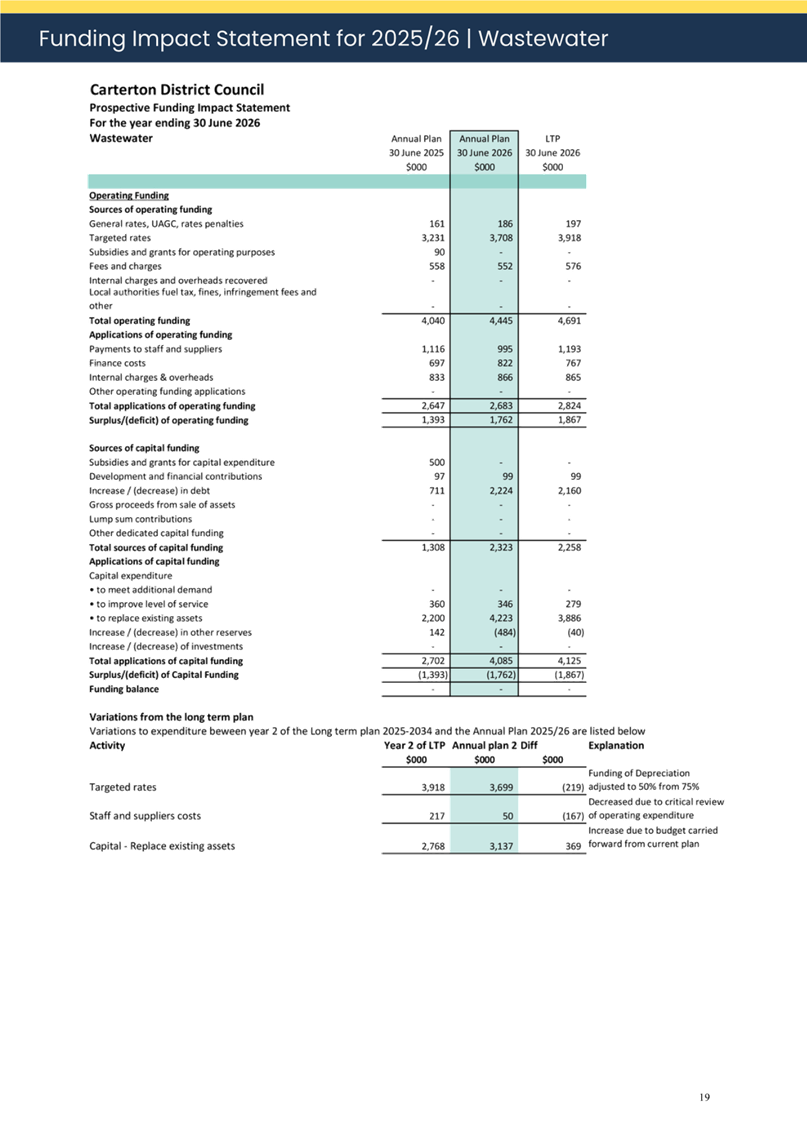

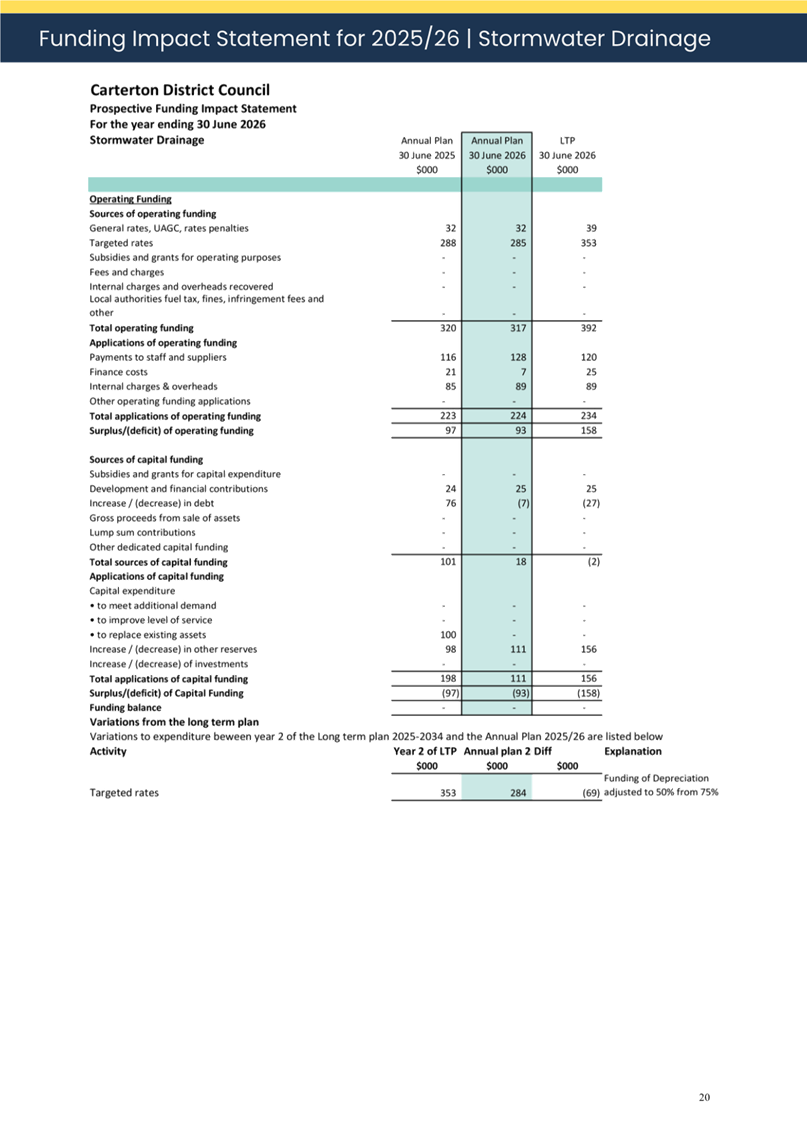

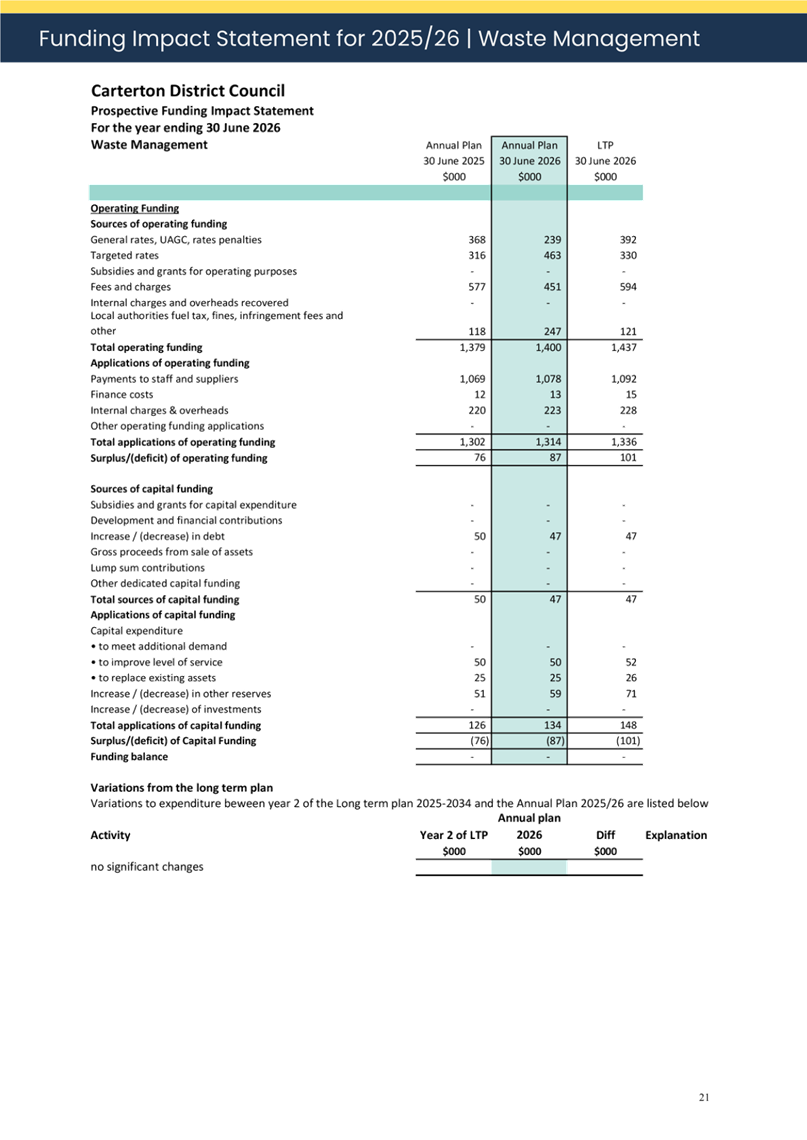

4.2 Further Changes from LTP

Council sought advice on the potential to deferring the

proposed uplift in waters depreciation funding - planned to go from 50% to 75%

in 2025/26 as part of the Long-Term Plan decisions.

Deferring this change is inconsistent with the 2024-34

Long-Term Plan. The Local Government Act 2002 (LGA) provides for the fact

that sometimes Councils make decisions that are inconsistent with previous

decisions or previously adopted policies. The LGA treats Long-Term Plans

as a policy decision of Council, and as such provides a mechanism for amending

these decisions.

The Cl 96 (3) of the Local Government Act

2002 states

Subject to section 80 ….. a

local authority may make decisions that are inconsistent with the contents of

any long-term plan or annual plan.”

Section 80 states a local authority must

clearly identify;

a) The

inconsistency; and

b) The

reasons for the inconsistency; and

c) Any

intention of the local authority to amend the policy or plan to accommodate the

decision.”

Furthermore, Council needs to satisfy

itself any proposed departure from the LTP is also considered against the

requirements of the LGA and other Council policies should these be

relevant.

Under

our Significance and Engagement Policy waters assets are considered named

Strategic Assets. Consultation on the proposed transfer of these assets

to a joint Water Services Council Owned Organisation (WSCOO) occurred during

April 2025, followed by Hearings and Deliberations in May 2025.

Other

key factors contemplated as part of our Significance and Engagement Policy have

also been considered including the effects of the proposed change on

ratepayers’ groups, the amounts involved, and any potential impact on

levels of service. After taking legal advice, Management does not believe

the proposal to defer the increase in water depreciation charges for 2025/26

requires further consultation.

Management

considers that the impact of deferring the change in waters deprecation charges

by one year will:

1. reduce

targeted waters rates rises for urban and commercial ratepayers.

2. will

not adversely affect remaining ratepayers.

3. will

not negatively affect any ratepayer groups.

4. does

not appear to be significant.

5. is

short term and reversable.

6. will

not affect levels of service.

7. will

not impact our prudence benchmarks.

8. will

not affect our balanced budget across the LTP period.

9. is

inconsistent with our LTP, but not of such significance that it requires an LTP

amendment or further consultation.

10. is

provided for in the Local Government Act 2002.

In

summary Council can defer the increased ratepayer funding of waters

depreciation from 50% to 75% for the 2025/26 fiscal year without the need for

further consultation, as long as the requirements of section 80 of the LGA 2002

are followed.

The

reason for the deferral, or inconsistency with the Long-Term Plan, is to reduce

the significant impact of rates rises on urban and commercial ratepayers caused

by the increase in waters depreciation charges.

Without

this deferral, the proposed increase in charges for ratepayers connected to, or

able to connect to, water supply and wastewater services would be

disproportionate to the average rates rise. Including this deferral

brings the average urban and commercial rates rises more in line with the

districts overall average rates rise.

An

amendment to the Long-Term Plan is likely to be needed following decisions

regarding Local Water Done Well. It is expected this will occur in late

2025 or early 2026. Consulting with the community on deferring waters

depreciation charges could also occur at the same time. Council may wish

to make this one-off deferral permanent, reverse it for 2026/27, or limit

future changes to water depreciation funding.

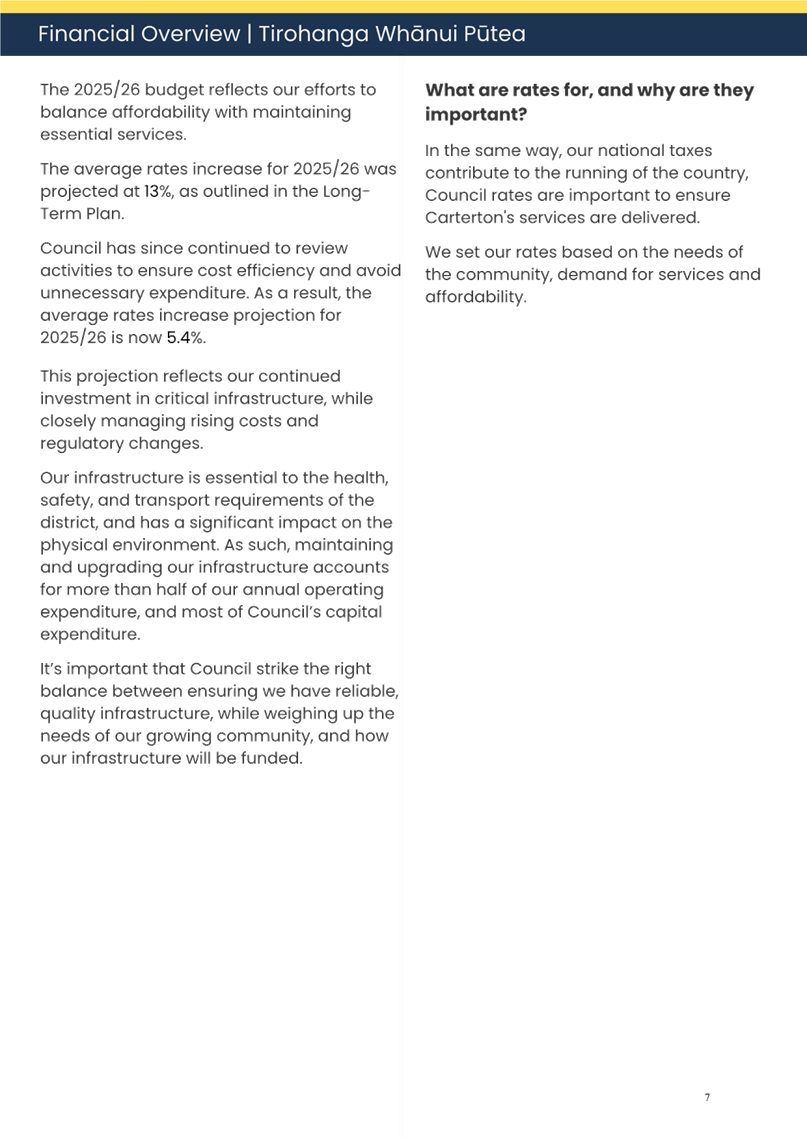

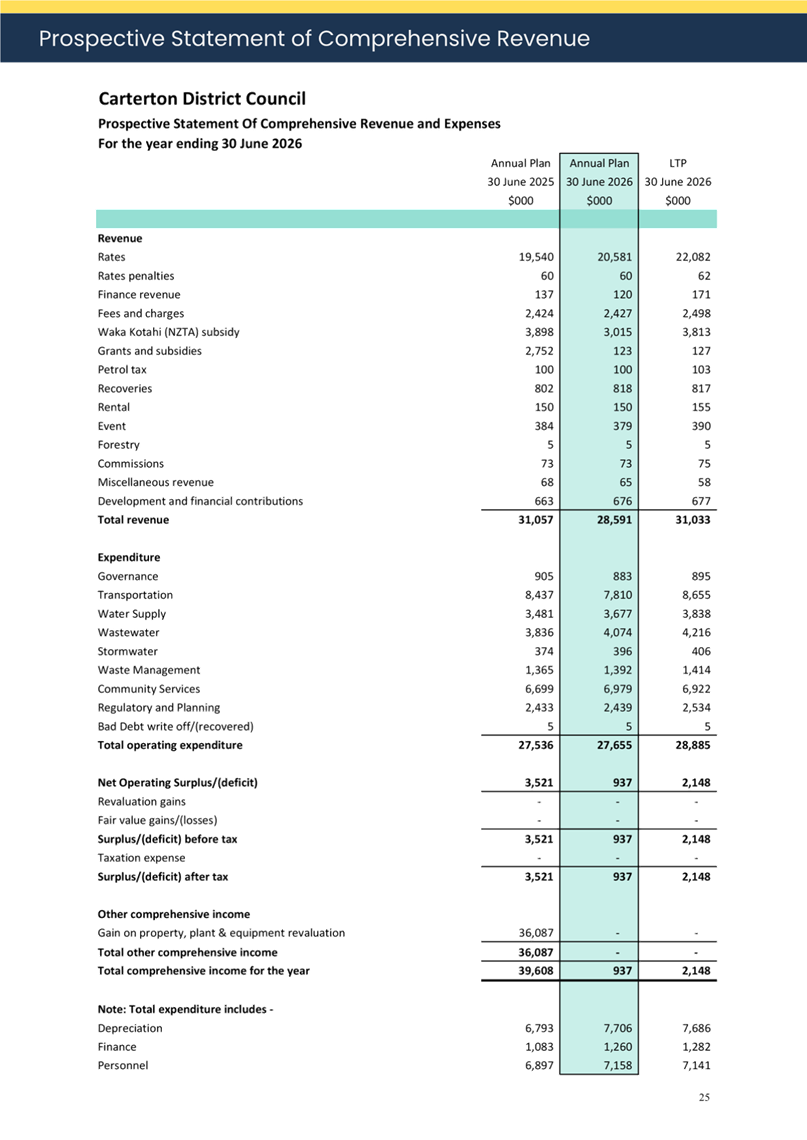

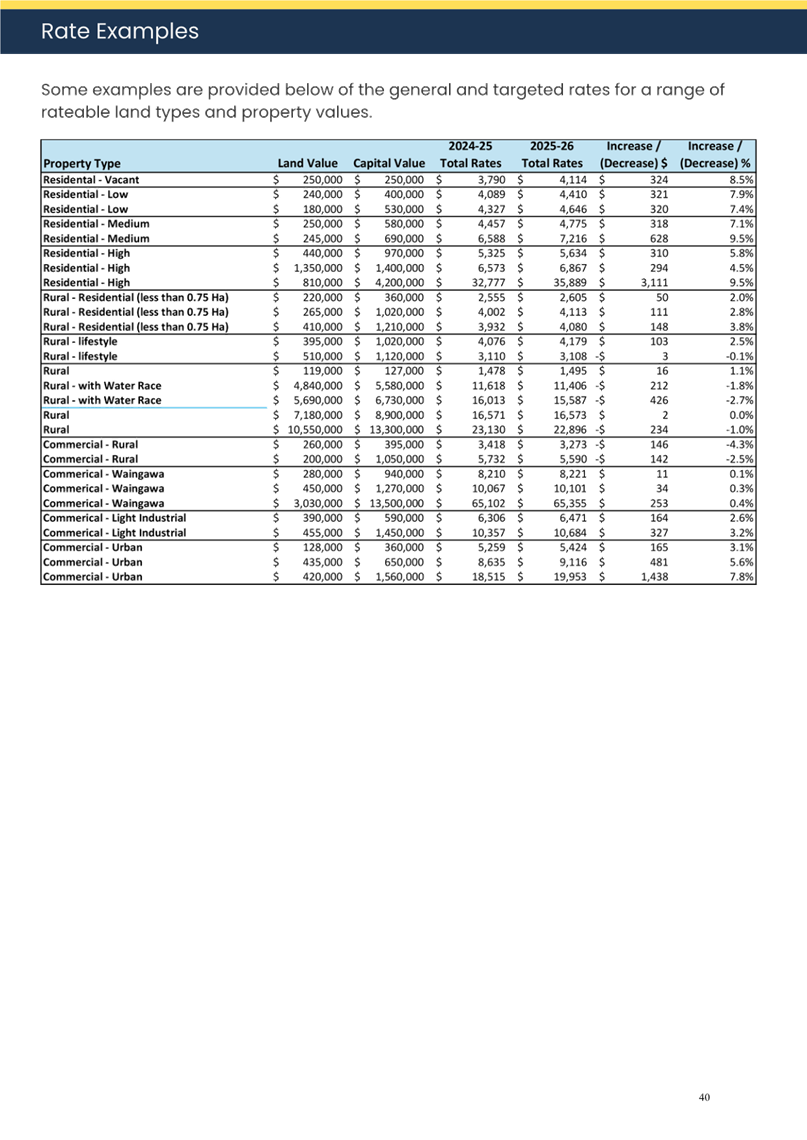

Average

rates increase

The

Long-Term Plan forecast an average increase in rates required for the 2025/26

year of 13.0%. Following the above-mentioned changes, the average increase in

rates required in the Draft 2025/26 Annual Plan has reduced to 5.4%.

The

average rates increase is across all rateable properties. The Draft

Annual Plan includes example properties across different rating categories and

values, indicating anticipated rates requirements for 2025/26 compared to last

year. Actual increases will vary depending on the specific

circumstances, services and values for each property.

The

increase also does not include any increase in Greater Wellington Regional

Council (GWRC) rates. GWRC set their rates independently, however CDC collects

rates on their behalf. GWRC’s average rates increase at time of writing

has yet to be confirmed.

Carry-forwards

Funding

for some capital projects included in the current financial year may need to be

carried forward into the 2025/26 year. These projects may be in progress,

but not yet fully completed. Other projects may still be in planning

stages but are still required to be completed.

A

review of capital projects will be undertaken at the end of the fiscal year to

determine if any project funding needs to carried-forward into the 2025/26

Annual Plan. These projects will be brought to Council for consideration.

5. CONSIDERATIONS

5.1 Climate change

No

specific considerations.

5.2 Tāngata whenua

No

specific considerations.

5.3 Financial impact

The

rates resolution enables Council to set its rates for the 2025/26 year.

5.4 Community Engagement requirements

Due

to the annual plan not being significantly different to year 2 of the Long-Term

Plan, formal consultation was not undertaken.

The

adopted Annual Plan will be published on the Council’s website within 30

days.

Council

will need to consider the requirements for further consultation on the proposed

changes to funding of Waters depreciation as part of the anticipated LTP

amendment required as part of Local Waters Done Well, in 2026.

5.5 Risks

No

specific risks identified.

6. RecommendationS

That the Council:

1. Receives

the report.

2. Notes

changes made to the second year of the 2024-34 Long-Term Plan have been

reflected in the draft 2025/26 Annual Plan.

3. Notes the

deferral of the increased ratepayer funding of

waters depreciation from 50% to 75% for the 2025/26 fiscal year is inconsistent

with the 2024-34 Long-Term Plan.

4. Notes the deferral of increased ratepayer funding of waters

depreciation can be considered by Council without the need for further

consultation.

5. Notes

Council will consider further public consultation on deferring ratepayer

funding of waters depreciation in 2026.

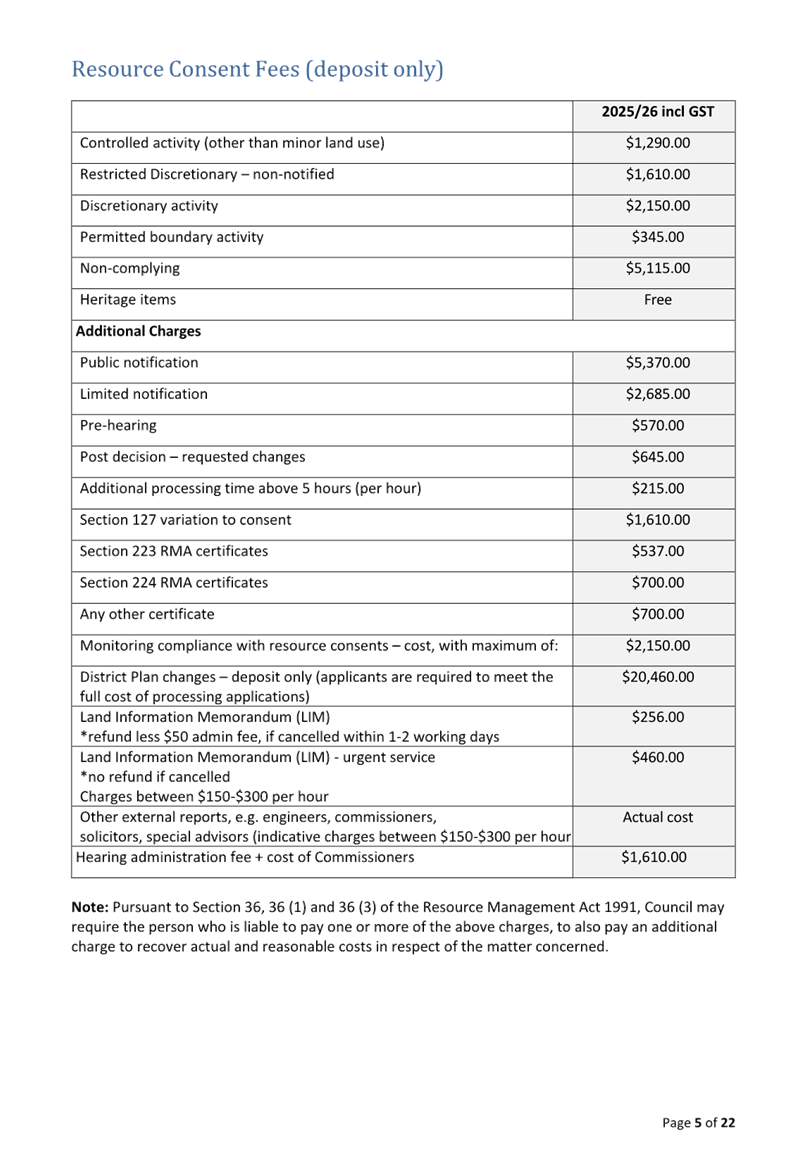

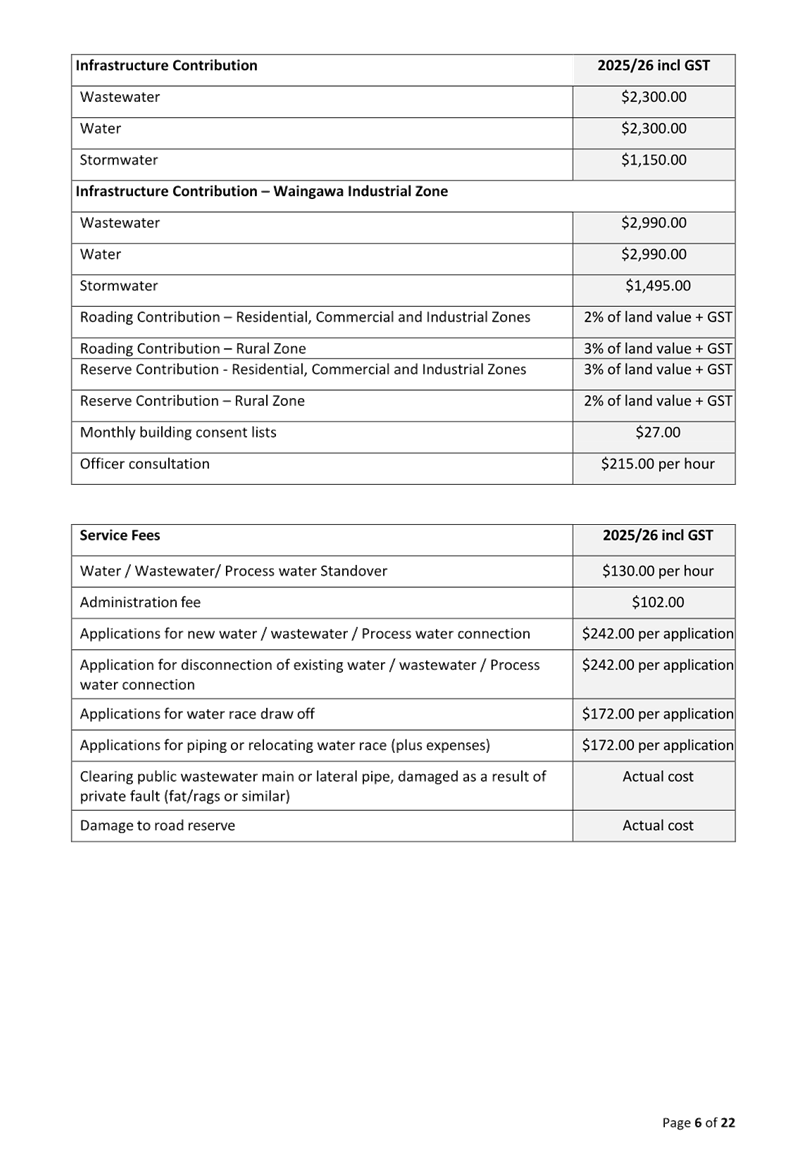

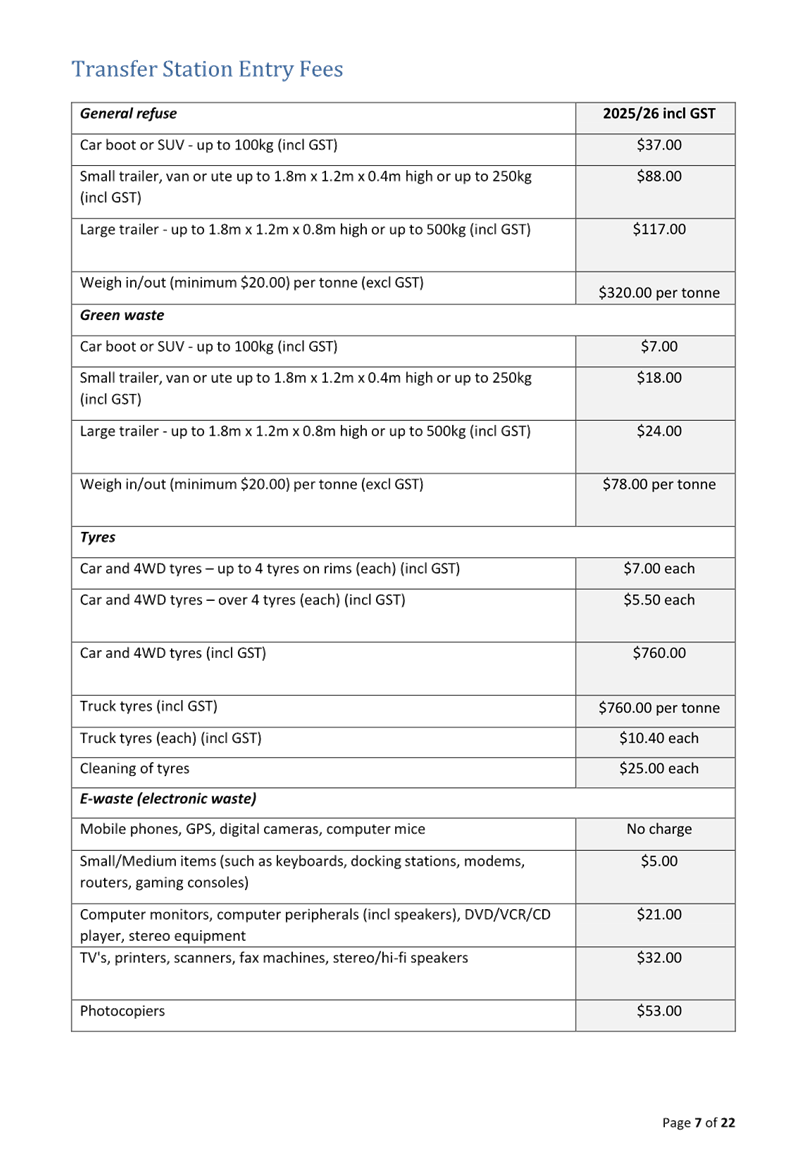

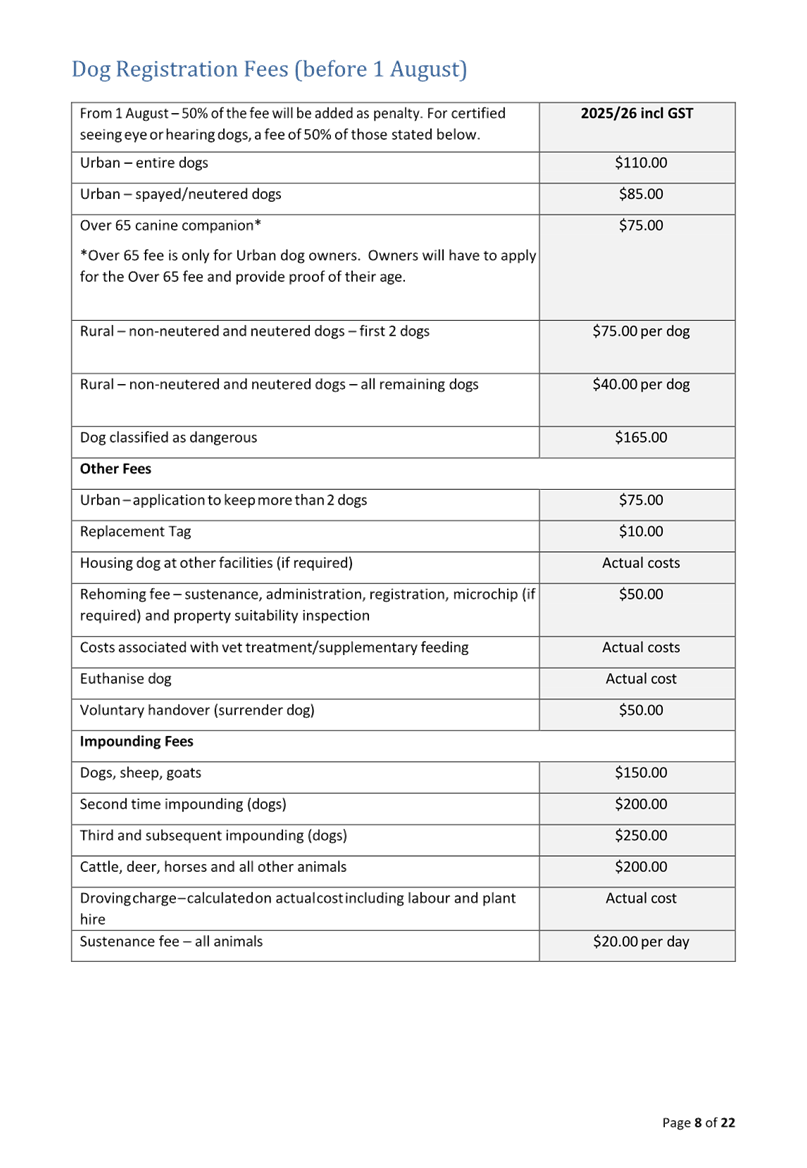

6. Adopts, pursuant to Section 95 of the Local Government

Act 2002, the draft Annual Plan 2025/26,

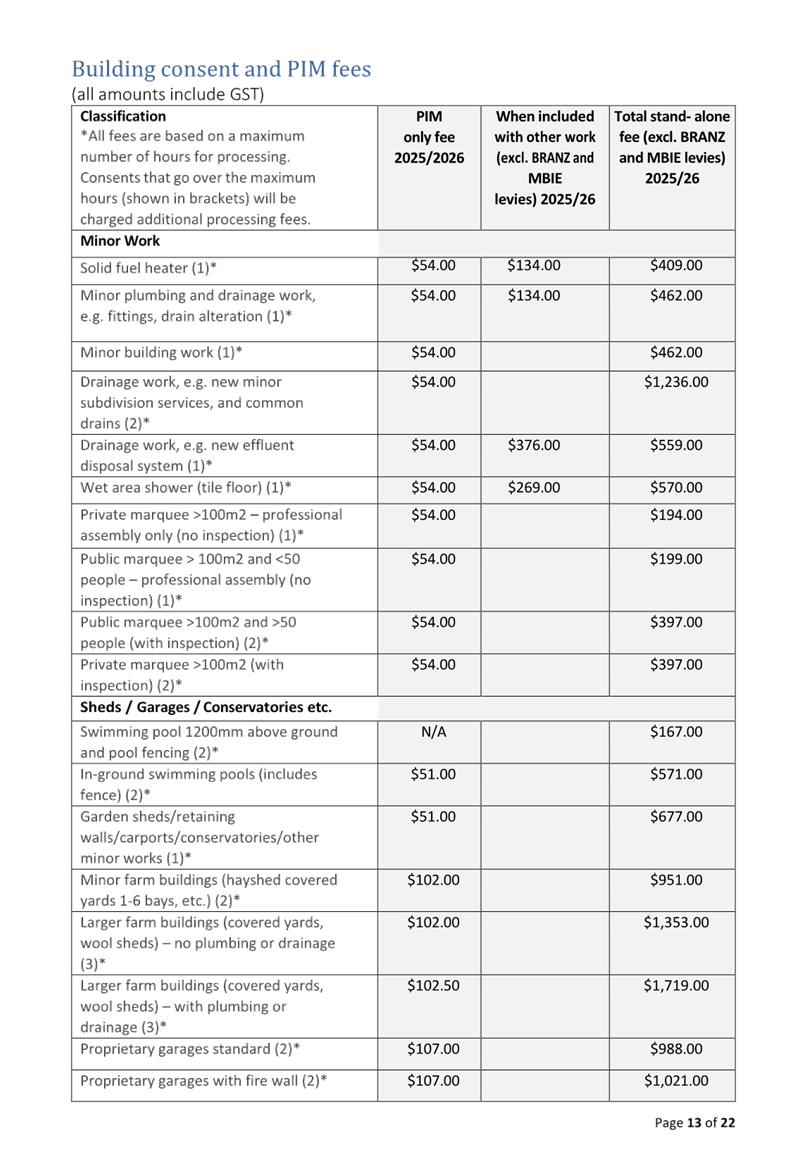

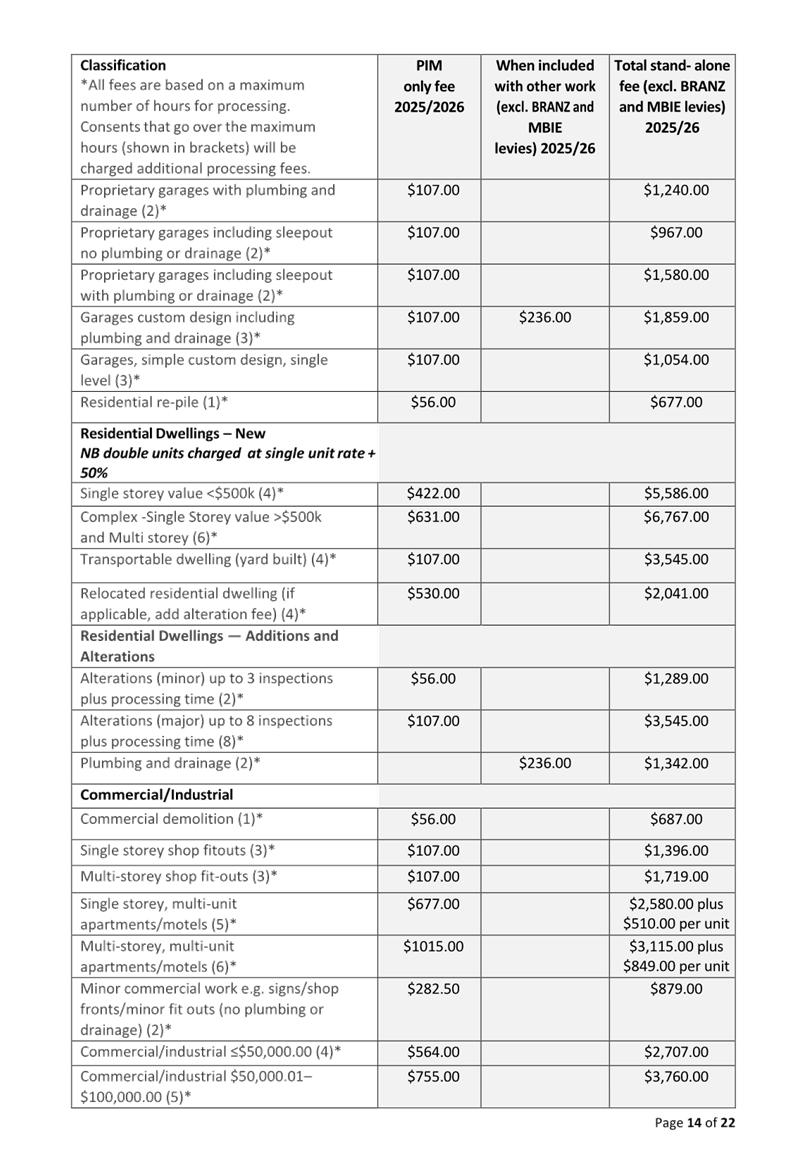

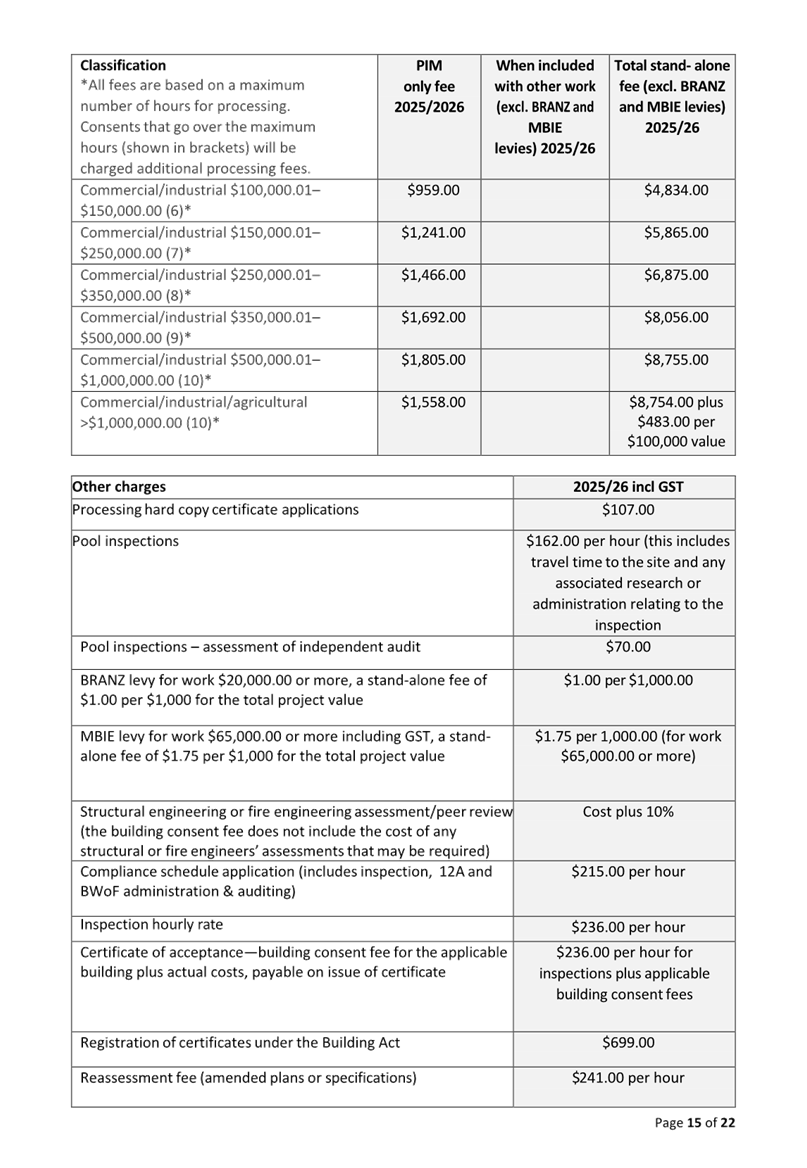

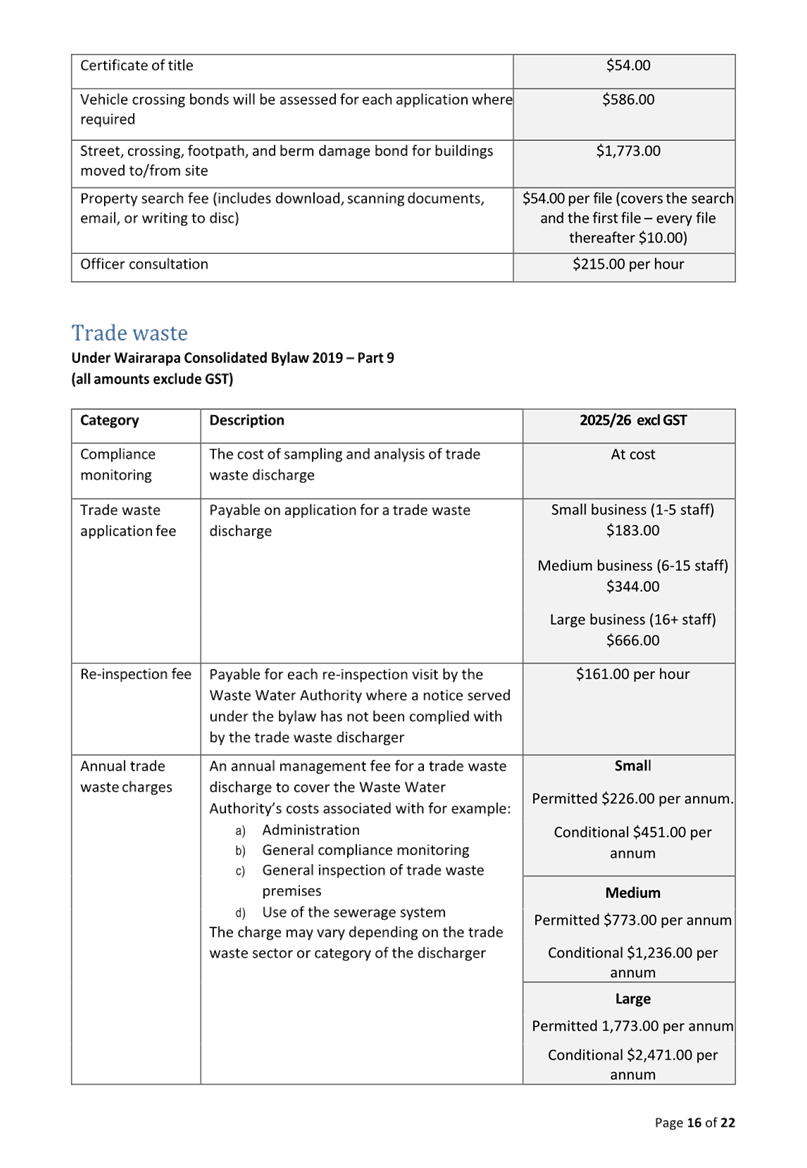

including the schedule of fees and charges in Attachment 1 and 2.

7. Delegates

authority to the Mayor and Chief Executive to make minor editorial changes to

the draft Annual Plan 2025/26 prior to publication.

File

Number: 453390

Author: Geoff

Hamilton, Chief Executive

Attachments: 1. Annual

Plan 2025/26 ⇩

2. Schedule

of Fees and Charges 2025/26 ⇩

|

Ordinary

Council Meeting Agenda

|

11

June 2025

|

8.2 Setting

Rates for 2025-26

1. Purpose

For Council to

consider the setting of rates for the 2025-26 financial year.

2. Significance

In

accordance with the Council’s Significance and Engagement Policy, this

matter has been assessed as being critical to the financial management of the

Council. A special consultative process was undertaken prior to the

adoption of the Long-Term Plan 2024-34 in September 2024.

Changes

made to the Draft Annual Plan and the rates requirement for 2025/26 are not

considered sufficiently different from the Long-Term Plan 2024-34, such that

further consultation may be required.

3. INTRODUCTION

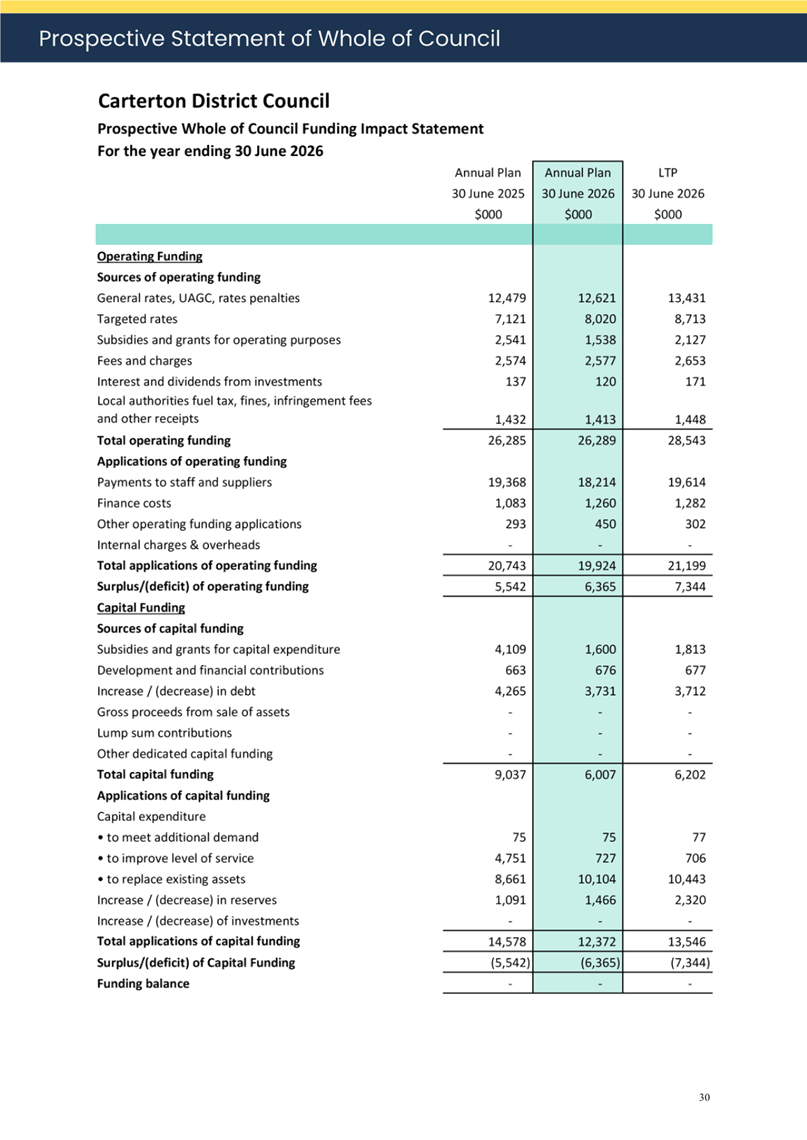

This report is the

final step in the process of being able to set the rates for the 2025-26

financial year following the adoption of the 2024-2034 Long-Term Plan. The

rates included in the report are part of the Funding Impact Statement that is

included in the 2025-26 Annual Plan.

The rating system

comprises general and targeted rates, and specific charges such as the uniform

annual general charge and excess water meterage charges.

Approach to Rating

Rates are set and

assessed under the Local Government (Rating) Act 2002 on rating units.

Some rates are assessed on the value of the land and improvements, or the value

of the land alone, as supplied by Quotable Value New Zealand Limited. The current

rating valuation is dated 1 September 2023 and is effective from 1 July 2024.

These are reviewed every three years.

The objectives of the

council’s rating policy are to:

· Spread the

incidence of rates as fairly as possible

· Be consistent in

charging rates

· Ensure all

ratepayers pay their fair share for council services

· Provide the income

needs to meet the council’s goals.

The Carterton District

Council’s rating system provides for all user charges and other income to

be taken into account first, with the rates providing the balance needed to

meet council’s objectives.

4. RISK

Assessment

Setting

of the rates is a requirement of the Local Government Act 2002 (LGA) and the

Section 23 of Local Government (Rating) Act 2002 (LGRA). Council is required to

set the rates in accordance with these Acts to ensure they are lawful and can

be collected from ratepayers. The nature of the resolution recommended to

Council is aligned with legal advice.

5. OPTIONS

ANALYSIS

Option

1

Pursuant

to Section 23(1) of the Local Government (Rating) Act 2002, the Council

resolves to set the rates, due dates and penalties regime for the 2025/26 year.

Option

2

Council

resolves to not set the rates, due dates and penalties regime for the 2025/26

year and to give Officers guidance on which amendments are needed. An amended

timeframe related to setting of rates would be required.

Setting

of rates is key for the service provision and the financial management and

funding of Council. Following the consideration and adoption of the Long-Term

Plan 2024 -2034, this allows the Council to collect the rates required to

deliver the service of Council for 2025-26. Not setting the rates would put

Council at financial risk.

Recommended

Option

This

report recommends Option 1 – that Council resolve to set the rates in

accordance with the 2025-26 Annual Plan.

6. Next

steps

Following

the setting of Rates, Council Officers will set the rates within the Council

rating system and following 1 July 2025, the first rates assessment will be

sent to ratepayers in July 2025.

7. Recommendation

That the Council:

Receives

the report:

Pursuant to Sections 23, 24 and 57 of the Local Government

(Rating) Act 2002, resolves to set the rates, due dates and penalties

regime for the 2025/26 financial year as follows:

All rate amounts stated are GST inclusive.

(a) General rate

A general rate on the capital value of each rating unit in

the district.

The general rate is set on a differential basis over three

rating categories as follows:

|

General rates – differential factor

|

|

|

Residential

|

1.0

|

|

Commercial

|

1.8

|

|

Rural

|

0.8

|

Where –

· Residential means:

- all rating units used primarily for residential purposes

within the residential zone of the Carterton District as depicted in the

District Plan

- all rating units located in the commercial and industrial

zones of Carterton District, as depicted in the District Plan, that are used

primarily for residential purposes

- all rating units associated with utility services (water,

telecommunications, etc.) that are located in the urban area.

· Commercial means:

- all rating units in the commercial zone of Carterton

District, including the Carterton Character Area, as depicted in the District

Plan, and all rating units outside the said commercial zone that have existing

use rights or resource consent to undertake commercial land use activities

under the Resource Management Act 1991

- all rating units in the industrial zone of Carterton

District, as depicted in the District Plan, and all rating units outside the

said industrial zone that have existing use rights or resource consent to carry

out industrial land use activities under the Resource Management Act 1991.

- Excludes any rating units used primarily for residential

purposes

- Includes any rating units within the rural zone of

Carterton District, as depicted in the District Plan, holding or exercising

existing use rights or resource consent to carry out commercial or industrial

land use activities under the Resource Management Act 1991

· Rural means:

- all rating units within the rural zone of Carterton

District, as depicted in the District Plan, but excluding those rating units

that hold and are exercising existing use rights or resource consent to carry

out commercial or industrial land use activities under the Resource Management

Act 1991

- all rating units associated with utility services (water,

telecommunications, etc) that are located in the rural area.

A General Rate set under section 13(2)(b)

Local Government (Rating) Act 2002, on every rating unit on a differential

basis as described below:

• a

rate of 0.19184 cents in the dollar (including GST) of capital value on every

rating unit in the Residential category

• a

rate of 0.34531 cents in the dollar (including GST) of capital value on every

rating unit in the Commercial category

• a

rate of 0.15347 cents in the dollar (including GST) of capital value on every

rating unit in the Rural category

(b) Uniform Annual

General Charge

A Uniform Annual General Charge on

each rating unit in the district to fully fund Governance activities and to

fund Community Support activities within the maximum possible under section 21

of the Local Government (Rating) Act 2002.

The

Uniform Annual General Charge is calculated as one fixed amount per rating

unit, for the rating year 2025/26 this rate will be $1,288.18 (including GST)

per rating unit set under section 15(1)(a) Local Government (Rating) Act 2002.

(c )

Targeted rates

Regulatory and planning service rate

A regulatory and planning service rate for regulatory,

resource management, and district planning services on every rating unit in the

district, calculated on capital value.

A targeted Regulatory and Planning Services Rate of 0.00849

cents per dollar of capital value set under Section 16 Local Government

(Rating) Act 2002 on every rating unit in the district.

Urban

wastewater rates

A differential targeted rate for the Council’s urban wastewater

and treatment and disposal of wastewater services of a fixed amount per

separately used or inhabited part of a rating unit in relation to all land in

the district to which the Council’s urban wastewater service is provided

or available.

The rate applied is as follows:

· A charge per separately used or inhabited part of a rating

unit that is able to be connected

· A charge per separately used or inhabited part of a rating

unit connected

The Council also sets a rate (pan charge) per water closet or urinal

within each separately used or inhabited part of a rating unit after the first

one for rating units with more than one water closet or urinal.

For the purposes of this rate:

· ‘Connected’ means the rating unit is connected

to the Council’s urban wastewater service directly or through a private

drain.

· ‘Able to be connected’ means the rating unit is

not connected to the Council’s urban wastewater drain but is within 30

metres of such a drain.

· A separately used or inhabited part of a rating unit used

primarily as a residence for one household is treated as not having more than

one water closet or urinal.

a. A

rate of $635.32 per separately used or inhabited part of a rating unit set

under Section 16 Local Government (Rating) Act 2002 for rating units that are

not yet connected but are able to be connected to the Council’s urban

sewerage reticulation system.

b. a

rate of $1,270.64 per separately used or inhabited part of a rating unit set

under Section 16 Local Government (Rating) Act 2002 for rating units that are

connected to the Council’s urban sewerage reticulation system.

c. a

rate of $1,270.64 set under Section 16 Local Government (Rating) Act 2002 for

each water closet or urinal after the first in each separately used or

inhabited part of a non-residential rating unit connected to Council’s

urban sewerage reticulation system.

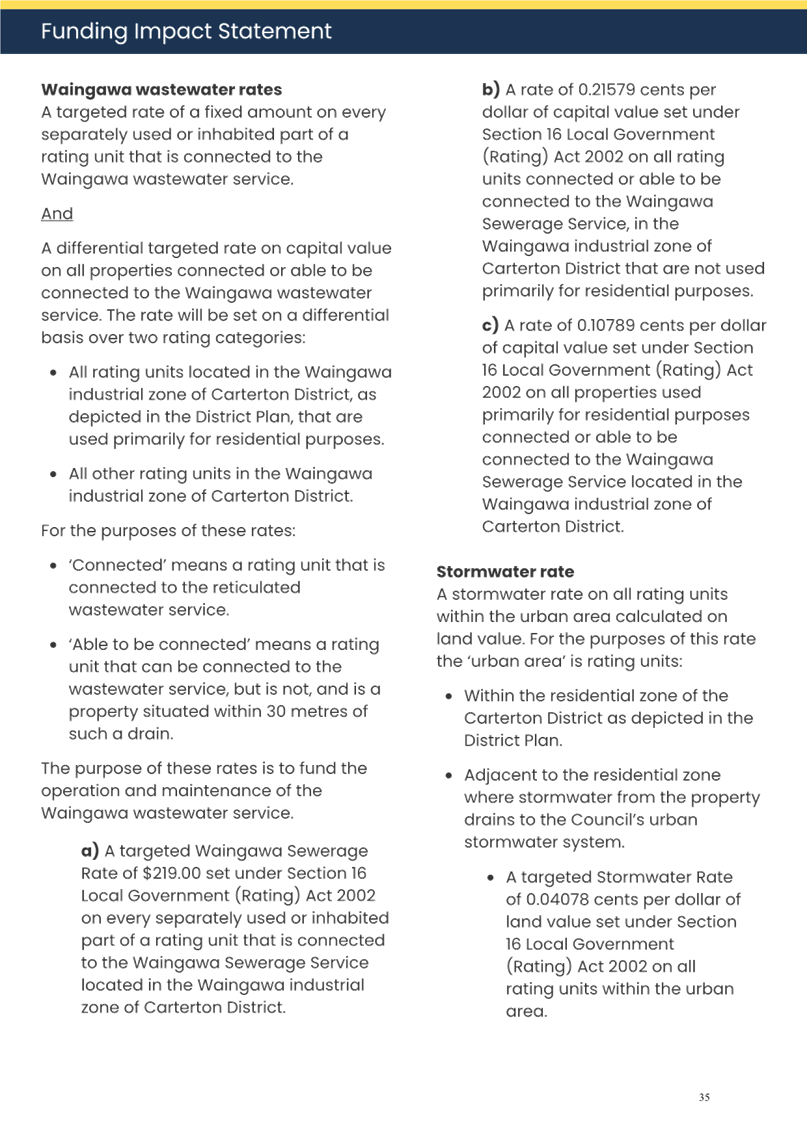

Waingawa wastewater rates

A targeted rate of a fixed amount on every separately used

or inhabited part of a rating unit that is connected to the Waingawa wastewater

service.

And

A differential targeted rate on capital value on all

properties connected or able to be connected to the Waingawa wastewater

service. The rate will be set on a differential basis over two rating

categories:

· All rating units located in the Waingawa industrial zone of

Carterton District, as depicted in the District Plan, that are used primarily

for residential purposes

· All other rating units in the Waingawa industrial zone of

Carterton District.

For the purposes of these rates:

· ‘Connected’ means a rating unit that is

connected to the reticulated wastewater service.

· ‘Able to be connected’ means a rating unit that

can be connected to the wastewater service, but it not, and is a property

situated within 30 metres of such a drain.

The purpose of these rates is to fund the operation and maintenance of

the Waingawa wastewater service.

a) a

targeted Waingawa Sewerage Rate of $219.00 set under Section 16 Local

Government (Rating) Act 2002 on every separately used or inhabited part of a

rating unit that is connected to the Waingawa Sewerage Service located in the

Waingawa industrial zone of Carterton District,

b) a

rate of 0.21579 cents per dollar of capital value set under Section 16 Local

Government (Rating) Act 2002 on all rating units connected or able to be

connected to the Waingawa Sewerage Service, in the Waingawa industrial zone of

Carterton District that are not used primarily for residential purposes,

c) a

rate of 0.10789 cents per dollar of capital value set under Section 16 Local

Government (Rating) Act 2002 on all properties used primarily for residential

purposes connected or able to be connected to the Waingawa Sewerage Service

located in the Waingawa industrial zone of Carterton District.

Stormwater rate

A stormwater rate on all rating units within the urban area calculated

on land value. For the purposes of this rate the ‘urban area’ is

rating units:

· Within the residential zone of the Carterton District as

depicted in the District Plan,

· Adjacent to the residential zone where stormwater from the

property drains to the Council’s urban stormwater system.

o a

targeted Stormwater Rate of 0.04078 cents per dollar of land value set under

Section 16 Local Government (Rating) Act 2002 on all rating units within the

urban area.

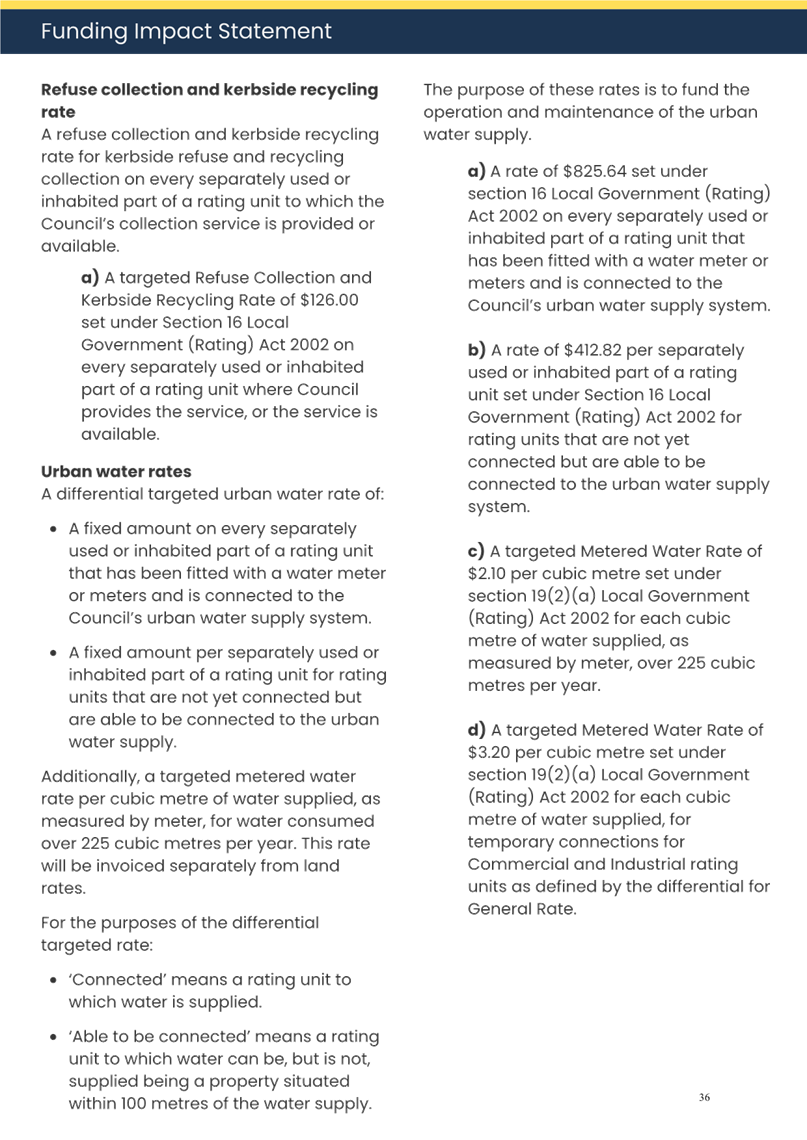

Refuse collection and kerbside recycling rate

A refuse collection and kerbside recycling rate for

kerbside refuse and recycling collection on every separately used or inhabited

part of a rating unit to which the Council’s collection service is

provided or available.

(a) a

targeted Refuse Collection and Kerbside Recycling Rate of $126.00 set under

Section 16 Local Government (Rating) Act 2002 on every separately used or

inhabited part of a rating unit where Council provides the service, or the

service is available.

Urban water rates

A differential targeted urban water rate of:

· a fixed amount on every separately used or inhabited part

of a rating unit that has been fitted with a water meter or meters and is

connected to the Council’s urban water supply system.

· of a fixed amount per separately used or inhabited part of

a rating unit for rating units that are not yet connected but are able to be

connected to the urban water supply.

Additionally, a targeted metered water rate per cubic metre

of water supplied, as measured by meter, for water consumed over 225 cubic

metres per year. This rate will be invoiced separately from land rates.

For the purposes of the

differential targeted rate:

· ‘Connected’ means a rating unit to which water

is supplied,

· ‘Able to be connected’ means a rating unit to

which water can be, but is not, supplied being a property situated within 100

metres of the water supply.

The purpose of these rates to fund the operation and maintenance of the

urban water supply.

(a) a

rate of $825.64 set under section 16 Local Government (Rating) Act 2002 on

every separately used or inhabited part of a rating unit that has been fitted

with a water meter or meters and is connected to the Council’s urban

water supply system,

(b) a

rate of $412.82 per separately used or inhabited part of a rating unit set

under Section 16 Local Government (Rating) Act 2002 for rating units that are

not yet connected but are able to be connected to the urban water supply

system,

(c) a

targeted Metered Water Rate of $2.10 per cubic metre set under section 19(2)(a)

Local Government (Rating) Act 2002 for each cubic metre of water supplied, as

measured by meter, over 225 cubic metres per year.

(d) A

targeted Metered Water Rate of $3.20 per cubic metre set under section 19(2)(a)

Local Government (Rating) Act 2002 for each cubic metre of water supplied, for

temporary connections for Commercial and Industrial rating units as defined by

the differential for General Rate.

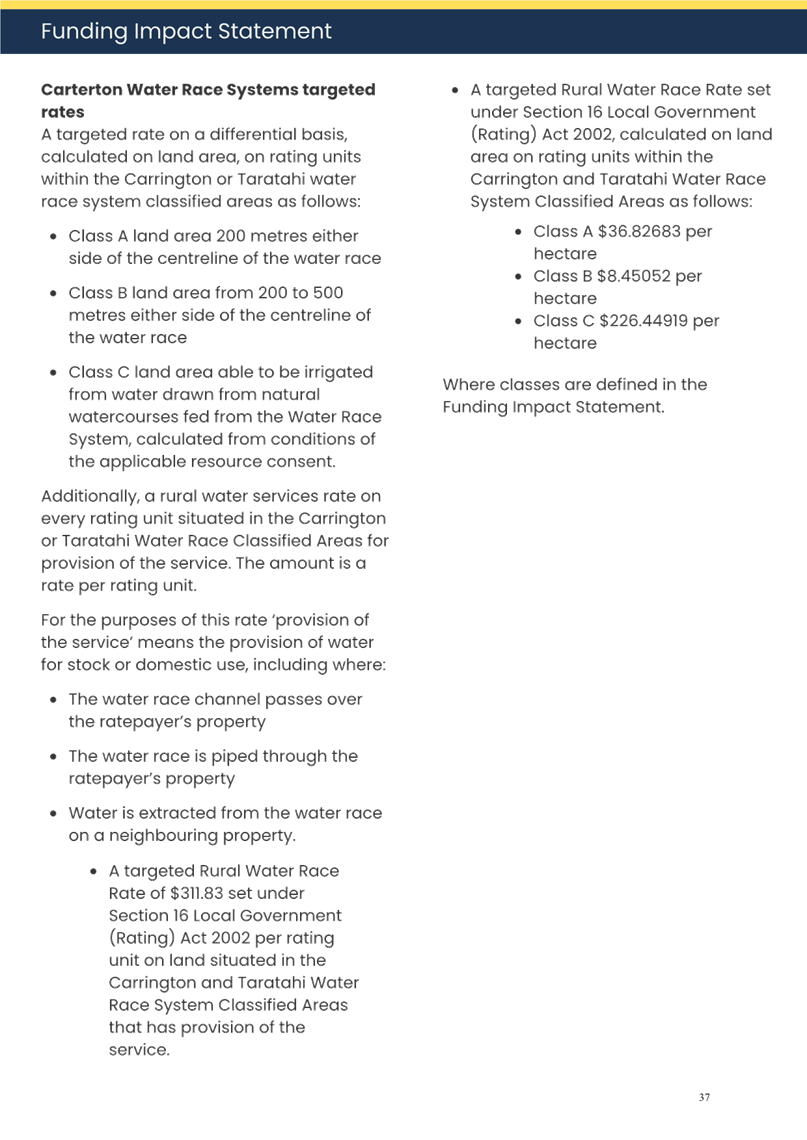

Carterton Water Race

Systems targeted rates

A targeted rate on a differential basis, calculated on land

area, on rating units within the Carrington or Taratahi water race system

classified areas as follows:

· Class A land area 200 metres either

side of the centreline of the water race

· Class B land area from 200 to 500

metres either side of the centreline of the water race

· Class C land area able to be

irrigated from water drawn from natural watercourses fed from the Water Race

System, calculated from conditions of the applicable resource consent.

A rural water services rate on every rating unit situated

in the Carrington or Taratahi Water Race Classified Areas for provision of the

service. The amount is a rate per rating unit. For the purposes of this rate

‘provision of the service’ means the provision of water for stock

or domestic use, including where:

· The water race channel passes over the ratepayer’s

property

· The water race is piped through the ratepayer’s

property

· Water is extracted from the water race on a neighbouring

property.

o a

targeted Rural Water Race Rate of $311.83 set under Section 16 Local Government

(Rating) Act 2002 per rating unit on land situated in the Carrington and

Taratahi Water Race System Classified Areas that has provision of the service.

o a

targeted Rural Water Race Rate set under Section 16 Local Government (Rating)

Act 2002, calculated on land area on rating units within the Carrington and

Taratahi Water Race System Classified Areas as follows:

• Class

A $36.82683 per

hectare

• Class

B $ 8.45052

per hectare

• Class

C $226.44919 per

hectare

where

classes are defined in the Funding Impact Statement.

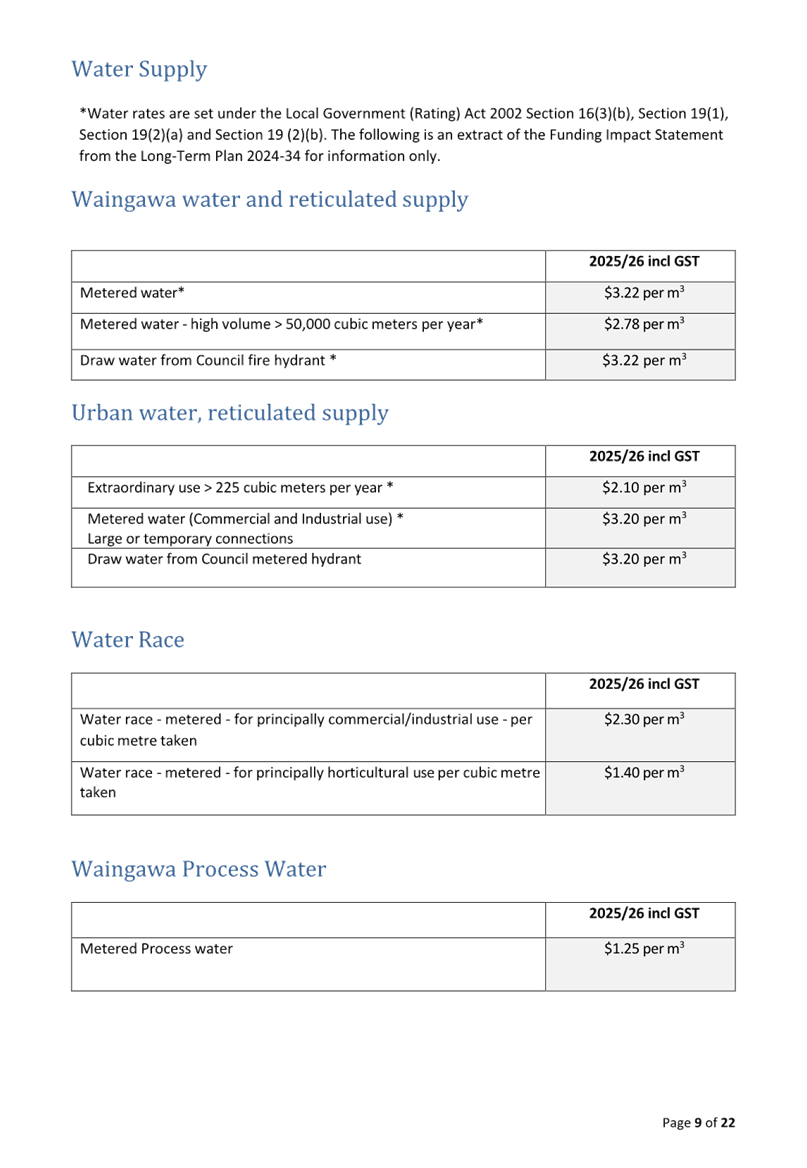

A metered Water Race rate for principally

commercial / industrial use – per cubic metre taken - $2.30 per m3.

A metered Water Race rate for principally

horticultural use per cubic metre taken - $1.40 per m3.

Waingawa Process Water – a metered

Process water rate per cubic metre taken - $1.25 per m3.

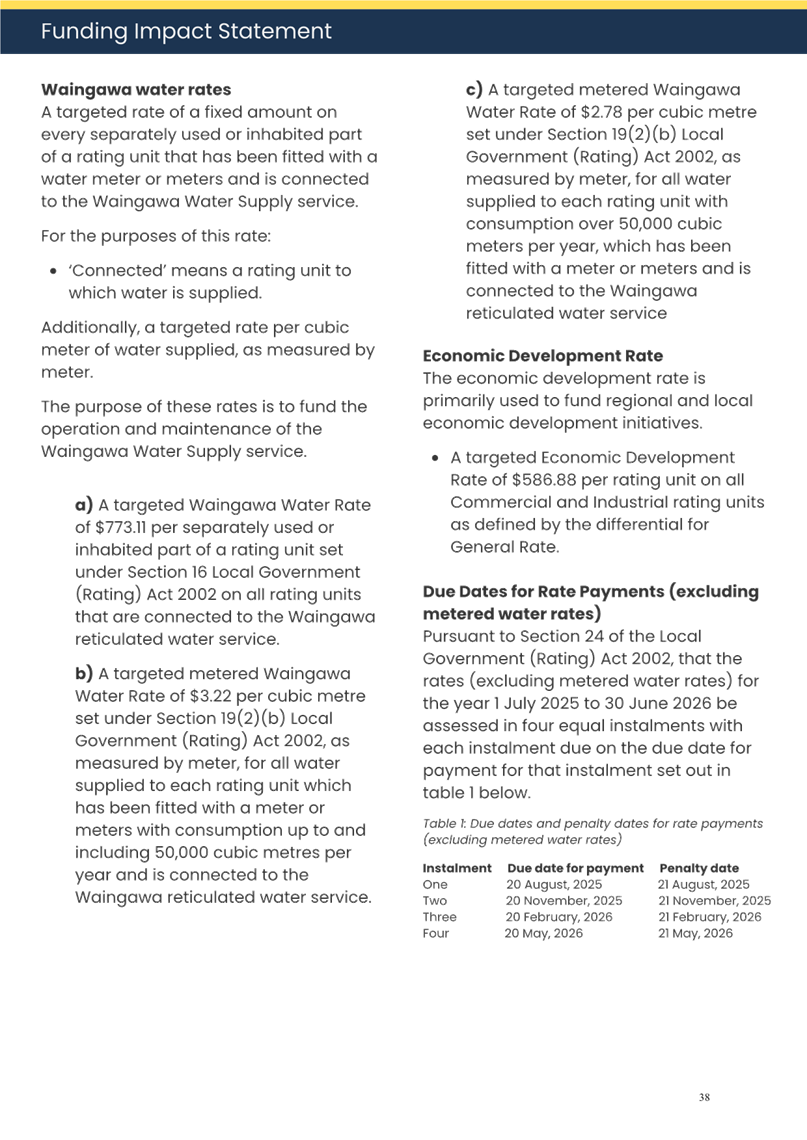

Waingawa water rates

A

targeted rate of a fixed amount on every separately used or inhabited part of a

rating unit that has been fitted with a water meter or meters and is connected

to the Waingawa Water Supply service.

For the purposes of this

rate:

· ‘Connected’ means a rating unit to which water

is supplied.

Additionally,

a targeted rate per cubic meter of water supplied, as measured by meter. This

rate will be invoiced separately from other rates.

The purpose of these rates

is to fund the operation and maintenance of the Waingawa Water Supply service.

(a) a

targeted Waingawa Water Rate of $773.11 per separately used or inhabited part

of a rating unit set under Section 16 Local Government (Rating) Act 2002 on all

rating units that are connected to the Waingawa reticulated water service.

(b) a

targeted metered Waingawa Water Rate of $3.22 per cubic metre set under Section

19(2)(b) Local Government (Rating) Act 2002, as measured by meter, for all

water supplied to each rating unit which has been fitted with a meter or meters

with consumption up to and including 50,000 cubic metres per year and is

connected to the Waingawa reticulated water service.

(c) a

targeted metered Waingawa Water Rate of $2.78 per cubic metre set under Section

19(2)(b) Local Government (Rating) Act 2002, as measured by meter, for all

water supplied to each rating unit with consumption over 50,000 cubic meters

per year, which has been fitted with a meter or meters and is connected to the

Waingawa reticulated water service.

Economic

Development Rate

The

economic development rate is primarily used to fund regional and local economic

development initiatives.

· a targeted Economic Development Rate of

$586.88 per rating unit on all Commercial and Industrial rating units as

defined by the differential for General Rate.

(d) Due

Dates for Rate Payments (excluding metered water rates)

Pursuant

to Section 24 of the Local Government (Rating) Act 2002, that the rates

(excluding metered water rates) for the year 1 July 2025 to 30 June 2026 be

assessed in four equal instalments with each instalment due on the due date for

payment for that instalment set out in table 1 below.

Table

1: due dates and penalty dates for rate payments (excluding metered water

rates)

|

Instalment

|

Due date for payment

|

Penalty date

|

|

One

|

20 August 2025

|

21 August 2025

|

|

Two

|

20 November 2025

|

21 November 2025

|

|

Three

|

20 February 2026

|

23 February 2026

|

|

Four

|

20 May 2026

|

21 May 2026

|

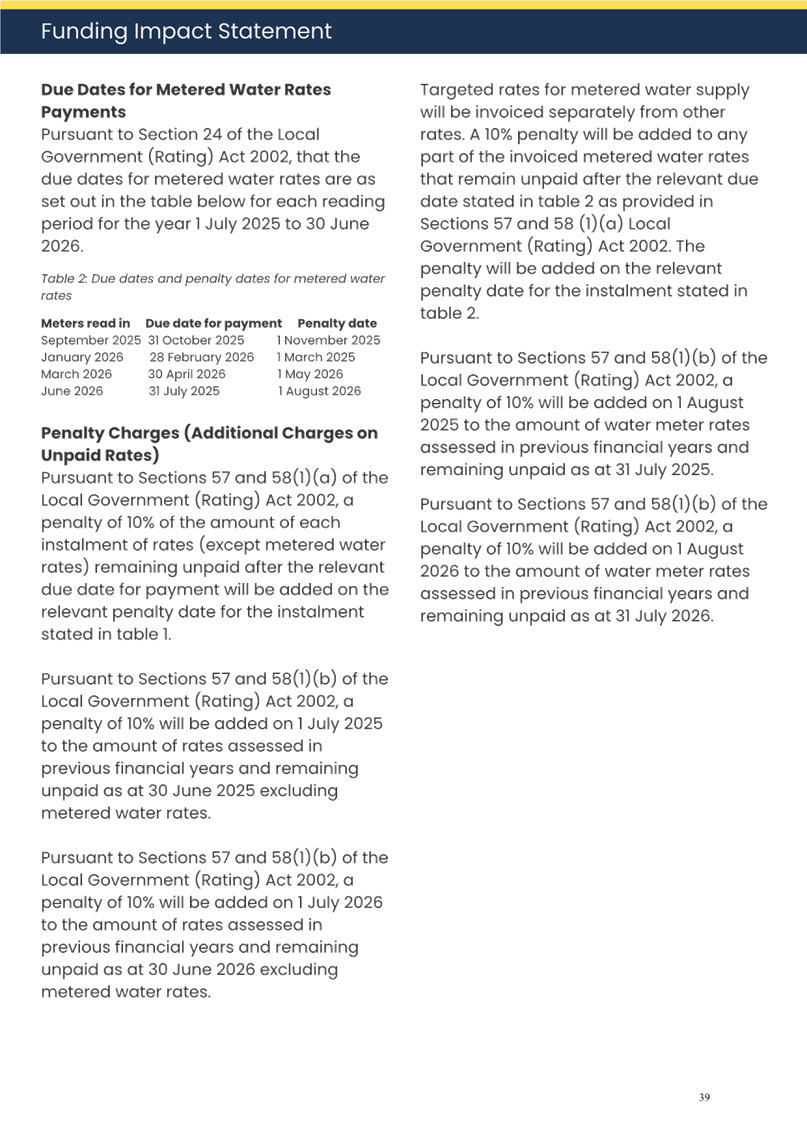

(e) Due

Dates for Metered Water Rate Payments

Pursuant to Section 24 of the Local

Government (Rating) Act 2002, that the due dates for metered water rates are as

set out in the table below for each reading period for the year 1 July 2025 to

30 June 2026.

Table

2: due dates and penalty dates for metered water rates

|

Meters

read in

|

Due

date

|

Penalty date

|

|

September

2025

|

31

October 2025

|

1

November 2025

|

|

January

2026

|

28

February 2026

|

1

March 2026

|

|

March

2026

|

30

April 2026

|

1 May

2026

|

|

June

2026

|

31

July 2026

|

1

August 2026

|

(f) Penalty

Charges (Additional Charges on Unpaid Rates)

Pursuant to Sections 57 and 58(1)(a) of

the Local Government (Rating) Act 2002, a penalty of 10% of the amount of each

instalment of rates (except metered water rates) remaining unpaid after the

relevant due date for payment will be added on the relevant penalty date for

the instalment stated in table 1.

Targeted rates for metered water supply

will be invoiced separately from other rates. A 10% penalty will be added to

any part of the invoiced metered water rates that remain unpaid after the

relevant due date stated in table 2 as provided in Sections 57 and 58 (1)(a)

Local Government (Rating) Act 2002. The penalty will be added on the relevant

penalty date for the instalment stated in table 2.

Pursuant to Sections 57 and 58(1)(b) of

the Local Government (Rating) Act 2002, a penalty of 10% will be added on 1

July 2025 to the amount of rates assessed in previous financial years and

remaining unpaid as at 30 June 2025 excluding metered water rates.

Pursuant to Sections 57 and 58(1)(b) of

the Local Government (Rating) Act 2002, a penalty of 10% will be added on 1

August 2025 to the amount of water meter rates assessed in previous financial

years and remaining unpaid as at 31 July 2025.

File

Number: 453391

Author: Geoff

Hamilton, Chief Executive

Attachments: Nil