|

Investment

Committee meeting Minutes

|

22

February 2023

|

MINUTES OF Carterton District Council

Investment Committee meeting

HELD AT THE Carterton Events Centre, 50

Holloway St, Carterton

ON Wednesday, 22 February 2023 AT

3:00 pm

PRESENT: Deputy Mayor Dale Williams (Interim Chair), Mayor Ron Mark,

Cr Lou Newman, Cr Steve Laurence

IN ATTENDANCE: Council staff

Geoff Hamilton (Chief Executive), Kelly Vatselias

(Corporate Services Manager), Elisa Brown (Communications and Engagement

Manager), Solitaire Robertson (Planning & Regulatory Services Manager),

Robyn Blue (Democratic Services Officer)

Other

Peter Verhaart (Eriksens

Global)

1 Karakia

Timatanga

The meeting opened with a karakia

by Deputy Mayor Dale Williams.

2 Apologies

There were no apologies received.

3 Conflicts

of Interests Declaration

There were no conflicts of

interest declared.

4 Public

Forum

There was no public forum.

5 Reports

|

5.1 Investment

Update Report

|

|

1. Purpose

The purpose of the report is to provide the Committee

with an update on Council’s investments.

|

|

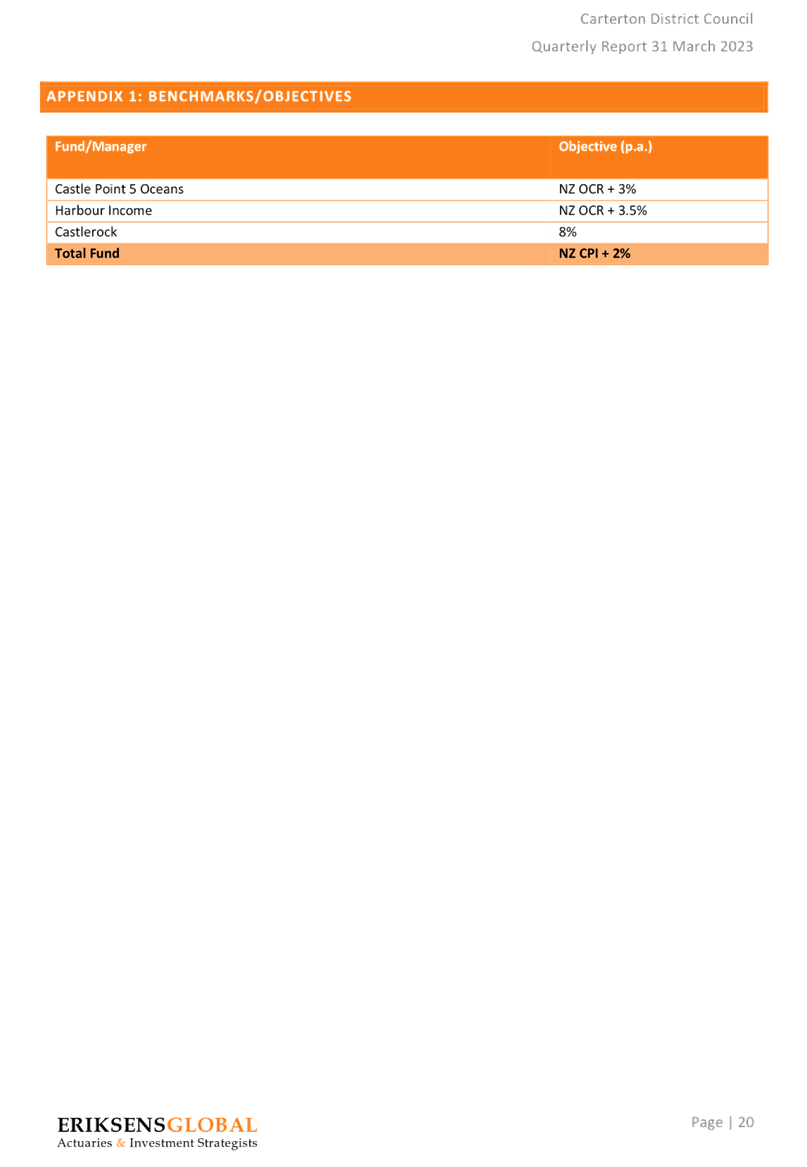

NOTED

·

In

2022 the previous Council made a commitment to invest $5M. $3M is

invested at the current time.

MOVED

That the Committee:

1. Receives

the report.

2. Agrees

to consider up to $2m of further investment in managed funds at the May

Investment Committee meeting.

Deputy Mayor D Williams / Cr L

Newman

CARRIED

|

6 Karakia

WhakamUtunga

The meeting closed with a karakia

by Deputy Mayor Dale Williams.

The Meeting closed at 3.35pm

Minutes confirmed:

……………………………………

Date: ...................................................

|

Investment Committee meeting Agenda

|

24 May 2023

|

6 Reports

6.1 Investment

Update Report

1. Purpose

The purpose of the

report is to provide the Committee with an update on Council’s

investments.

2. Significance

The

matters for decision in this report are not considered to be of significance

under the Significance and Engagement Policy.

3. Background

In

2022 the Council made to decision to invest in managed funds and set up an

Investment Committee to monitor Council’s investments.

The

use of managed funds has been considered as a way to maximise returns, and grow

the investment, while also being appropriately conservative with ratepayer

funds. The Treasury Management Policy, adopted by the Policy and Strategy

Committee on 1 June 2022 allows for Council to invest in externally managed

funds.

The

strategy to create a long-term investment fund was incorporated into the

2022/23 Annual Plan - the driver being that investment funds returns would

increase operating revenue earned and lessen the requirement to fund

expenditure via rates increases.

A

Statement of Investment Policy and Objectives (SIPO) was adopted by Council in

September 2022. The SIPO is the policy document that sets out the investment

governance and management framework, risk profile, investment philosophy,

strategies and expected objectives of an investment fund or portfolios.

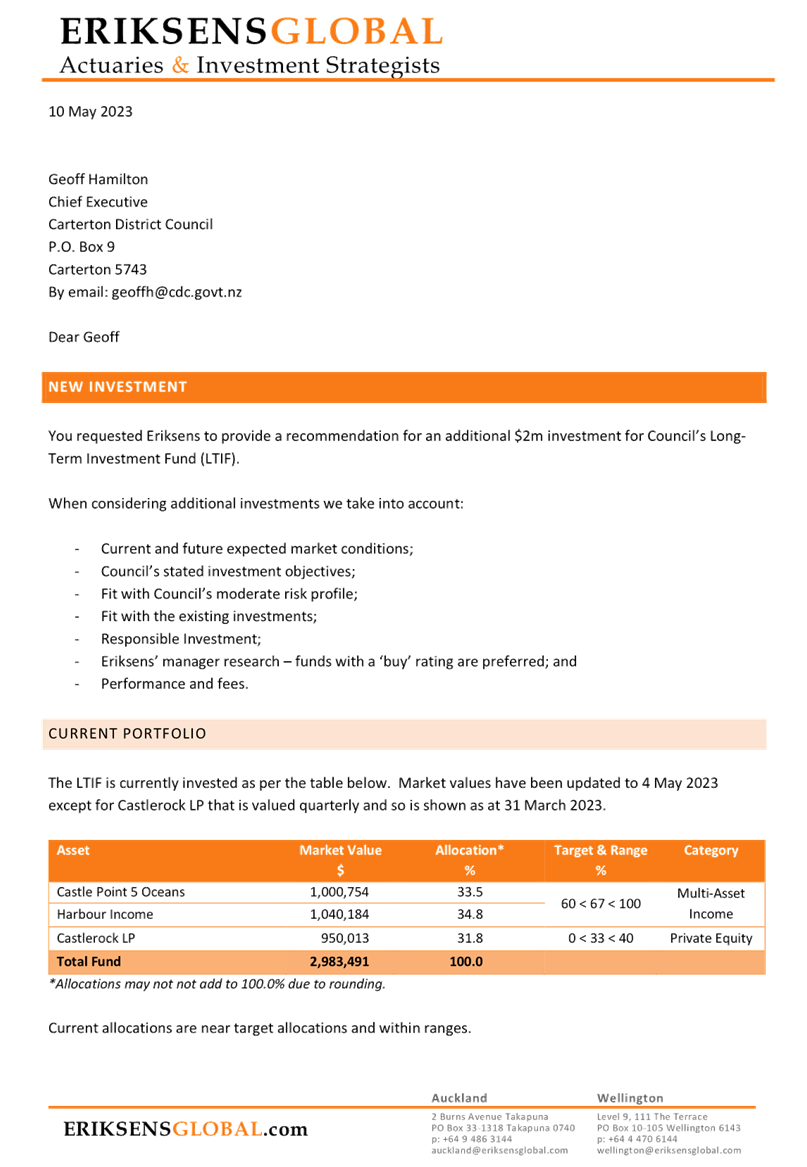

Council

has appointed Eriksens Global, Actuaries and Investment Strategists as the

Investment Advisor to the Committee. Eriksens Global provides independent,

expert advice specifically around investment strategy, management and fund

selection. They are currently involved with several councils around New

Zealand. Eriksens Global do not have investment products themselves -

unlike Milford, Fisher Funds, AMP etc. – they just provide investment

advice.

An

initial $3m was invested in managed funds, with a further $2m approved for

investment before the end of the current financial year.

CDC’s

investment position and management are reported at each Investment Committee

meeting.

This

report sets out the investment position as at 31 March 2023 advising the

Committee of the position of investments, their performance over the period,

and considers the plan going forward.

4. CURRENT

Investment POSITION

The

council’s investment position (at end of March 2023) is:

|

On

Call and up to 30 days

|

$365k

|

|

31

– 90 days

|

$11m

|

|

181

Days

|

$3m

|

|

Managed funds

|

$3m

|

|

Borrower

notes

|

$367k

|

|

TOTAL

|

$18m

|

5. Investments

Investments

held at 31 March 2023 amounted to $18 million, including $3 million in managed

funds. The balance is held within term deposits or at-call deposits and

borrower notes.

5.1 Bank investments

Investments

are held across three banks, BNZ, ANZ and Westpac. Call accounts reflect

our trading activity while cash and term deposits reflect operational or

special reserve investments; the latter are funds set aside for specific

purposes, such as infrastructure contributions. We also have Borrower

notes in our investment schedule. These are a percentage of the bonds (loans)

we have taken out with LGFA and are due when the bonds mature. They are

gathering a small amount of interest that is payable on maturity.

The

average interest rate on term investments is currently approximately 3.6%.

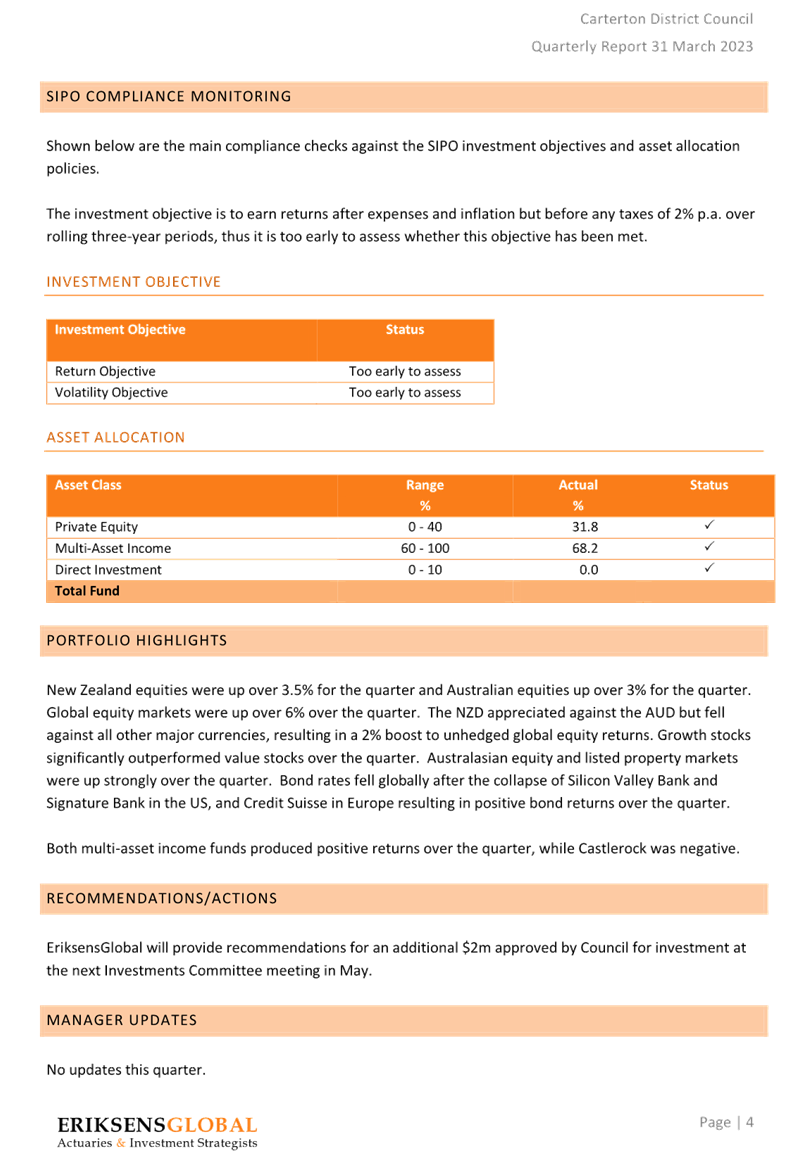

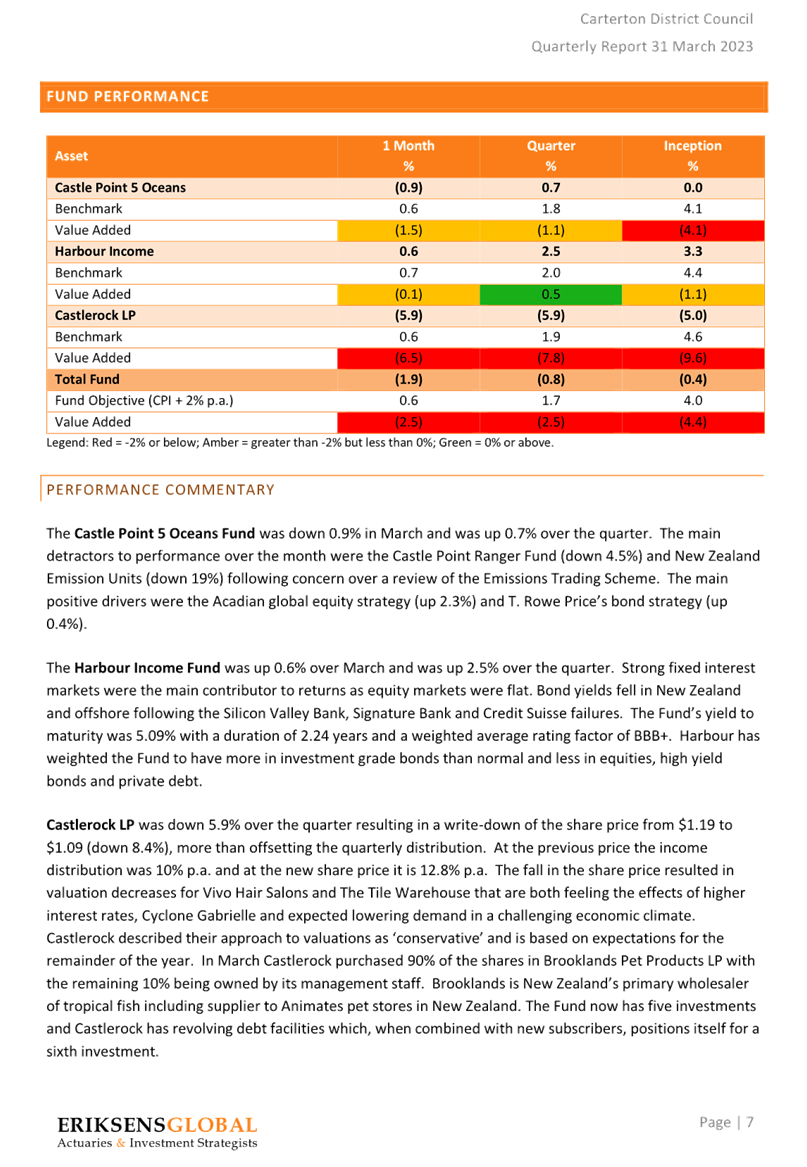

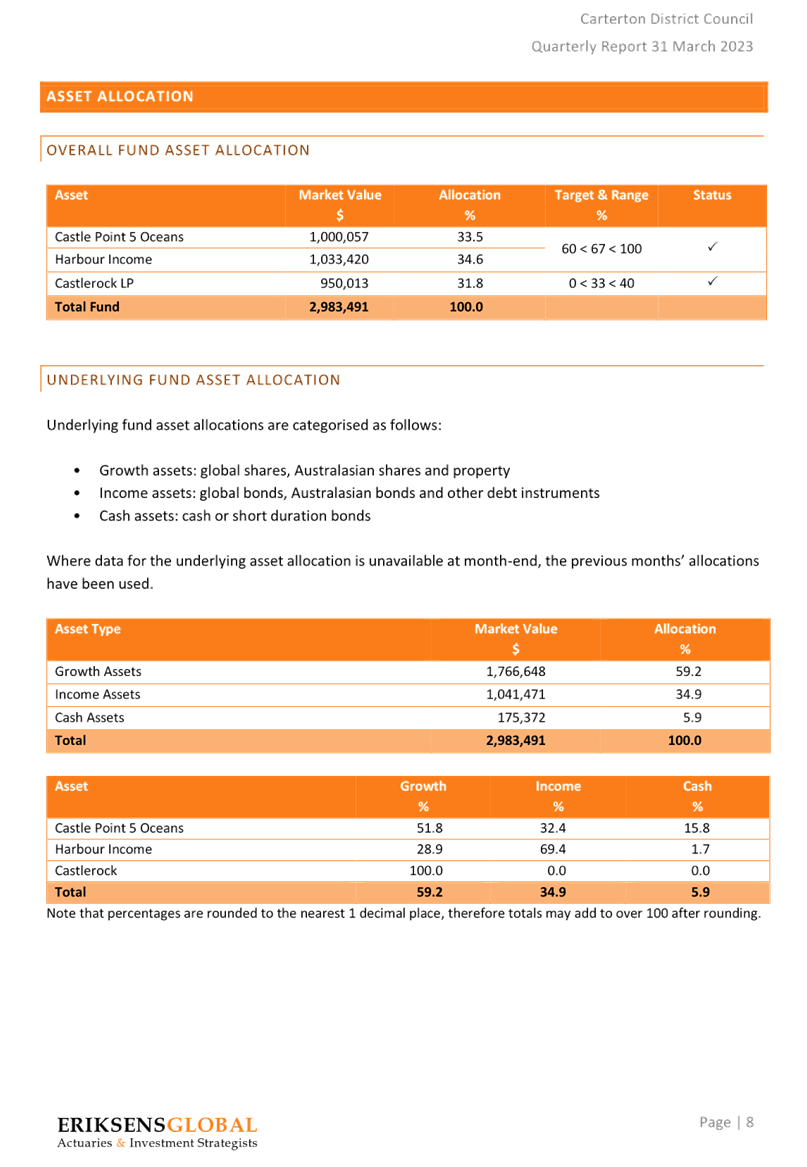

5.2 Managed funds

The

$3m invested in managed funds was split evenly between:

(a) Castle

Point Five Oceans Income Fund

(b) Harbour

Income Fund

(c) Castlerock

Growth Fund

At 31 March 2023 the

current position of these investments is shown in the investment schedule (Attachment

1).

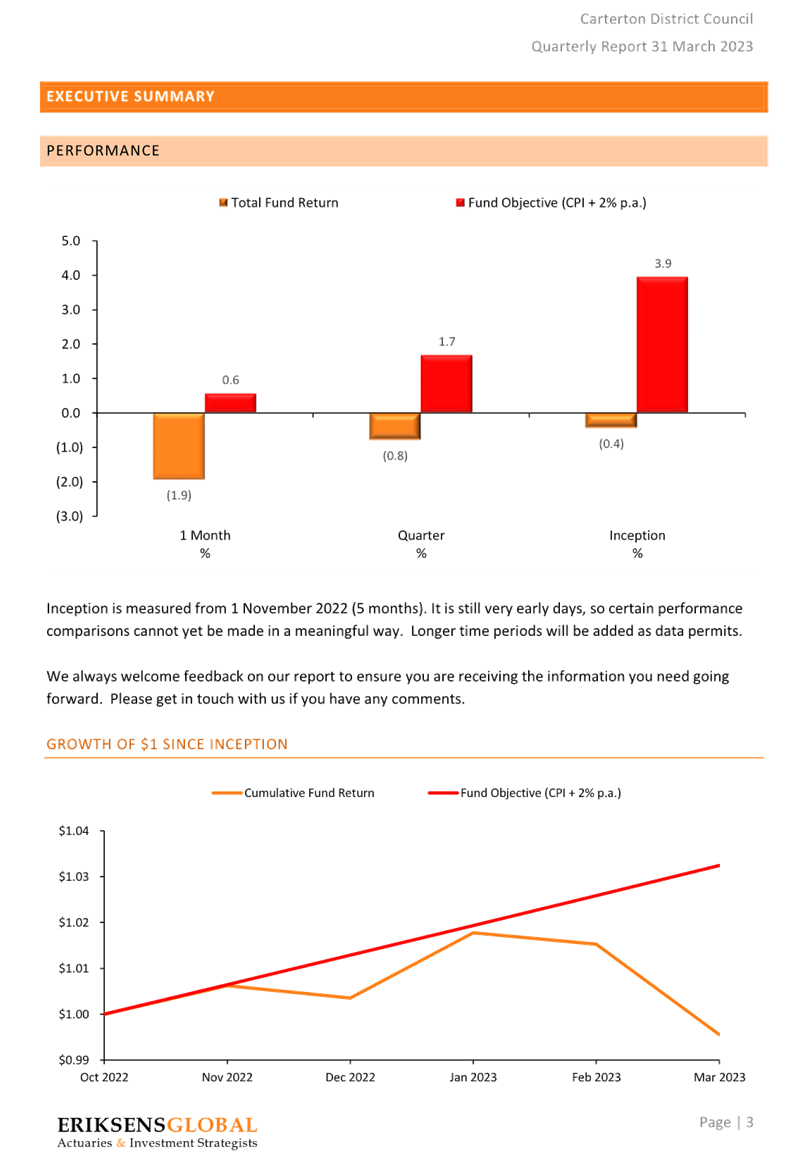

The 31 March 2023

report issued by Eriksen’s Global (Attachment 2) shows the

performance of the funds since investment (October/November 2022).

These investments are

intended to be held for a long period of time, and within that time the values

will fluctuate. It is still too early to form a view on fund performance given

the short time of investment to date.

6. future

planning

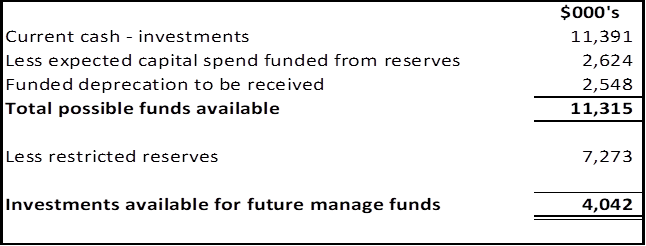

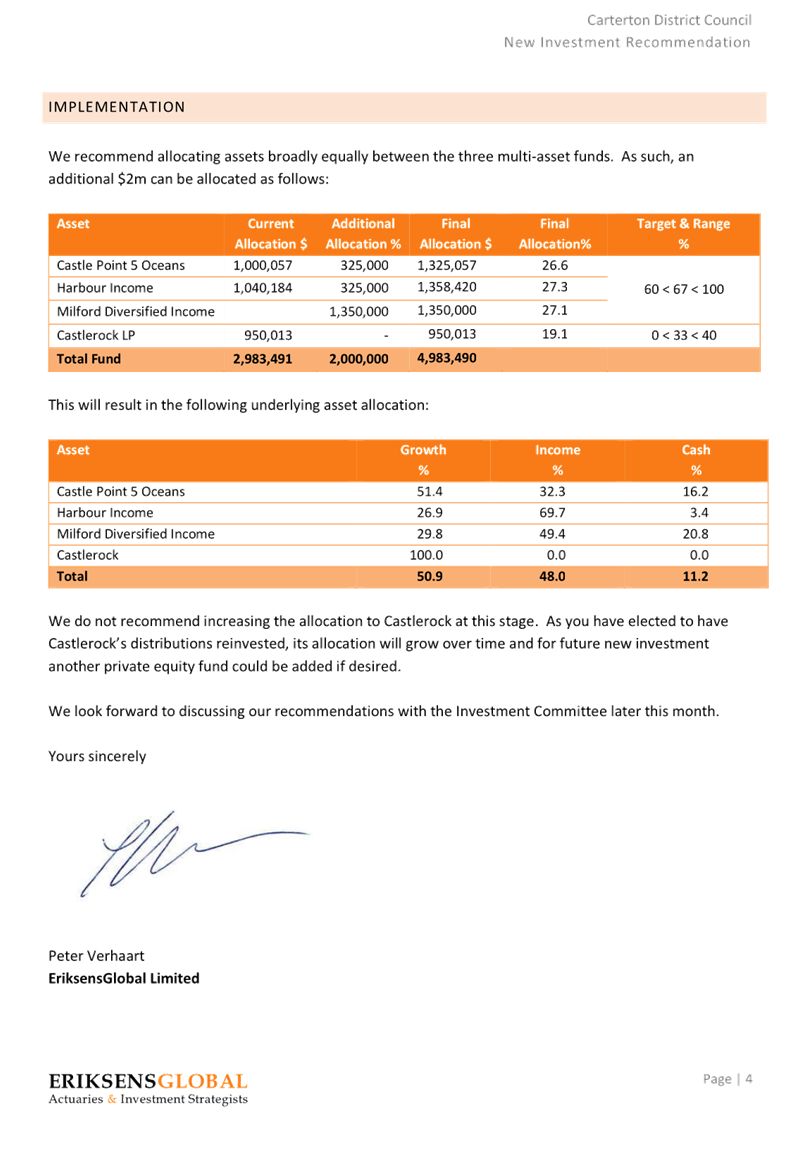

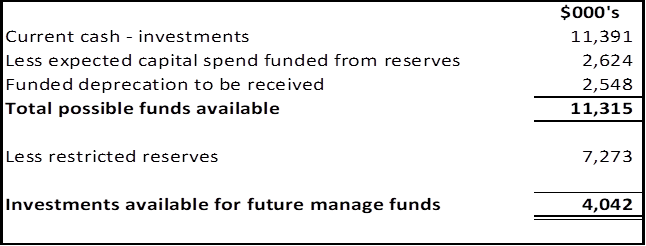

The table below shows

our current cash (excluding managed funds), the amount we are expecting to use

to fund our capital projects from reserves in the second half of the financial

year, and the funded depreciation we expect to receive in the second half of

this year (used to fund the capital programme). This gives a high-level view of

where we expect to see cash balances at year end. Movements from operating

expenditure and operating revenue have not been included, as these are expected

to largely net off against each other. Council has indicated a preference not

to invest restricted reserves in managed funds, which is why these amounts have

been removed from the possible funds available.

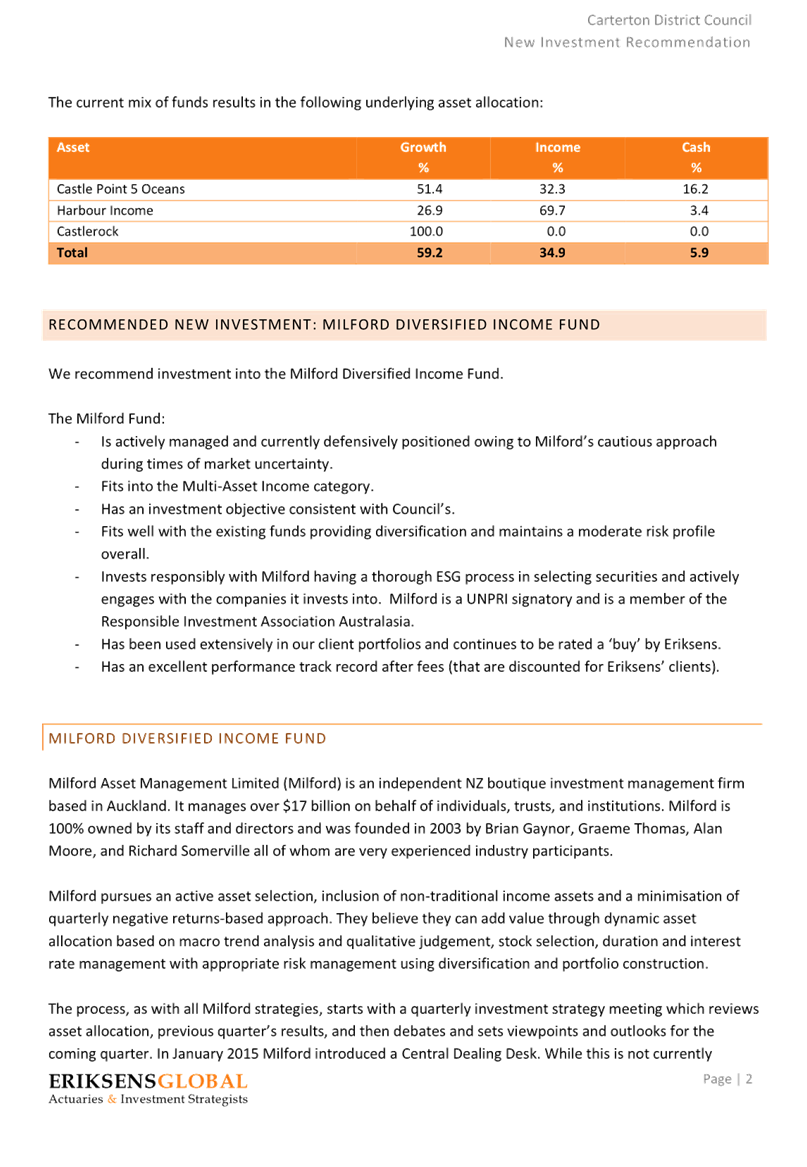

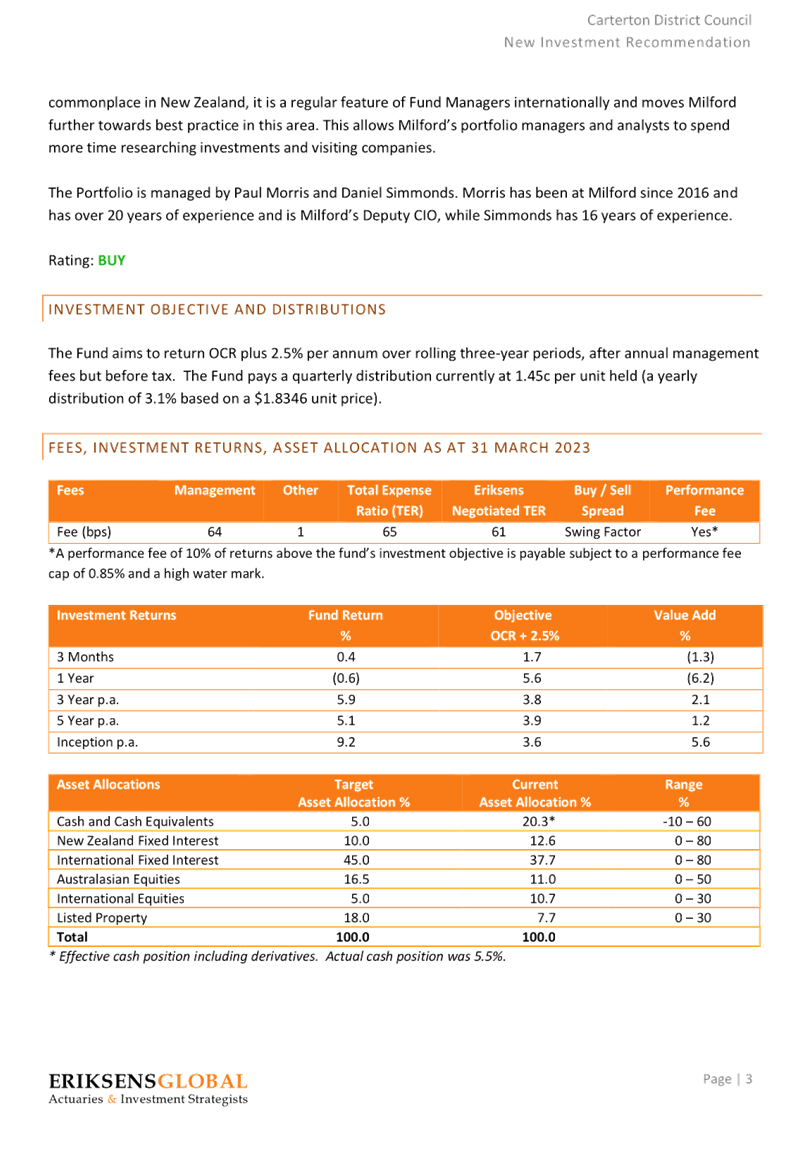

Council had approved a

further investment in managed funds of $2m before year end. It is recommended

by Officers that we proceed with this investment. Council has sufficient funds

to invest, with remaining cash reserves of $4m and we will be able to remain

within liquidity limits. Eriksens Global has provided us with a recommendation

for how the $2m could be invested (Attachment 3).

7. NEXT

STEPS

Staff

will continue to monitor and report on investment position to the Investment

Committee.

Staff

will continue work on cash-flow forecasting, including the remaining capital

programme and cash available for investment.

As

Council has already previously approved the further $2m investment via

resolution, we do not need to go back to Council for approval. However, we have

requested the Committee endorse the decision to invest the $2m at this time, as

well as the allocation to the multi-fund assets as recommended by Eriksens

Global.

8. CONSIDERATIONS

8.1 Climate change

There are no specific climate

change considerations.

8.2 Tāngata whenua

There

are no specific tāngata whenua considerations.

8.3 Financial impact

There

are no financial impacts resulting from the decisions in this report, other

than those already outlined above.

8.4 Community Engagement requirements

There

are no community engagement requirements.

8.5 Risks

Key risks

relate to investment management areas outlined above.

9. Recommendation

That the Committee:

1. Receives

the report.

2. Notes

the resolution of Council on 14 September 2022 that a further $2m will be

invested in long-term investment funds by 30 June 2023.

3. Endorses

the decision to invest a further $2m in long-term investment funds, with

the allocation as follows, as recommended by Eriksens Global:

(a) Castle

Point 5 Oceans: $325,000

(b) Harbour

Income: $325,000

(c) Milford

Diversified Income: $1,350,000

File

Number: 336420

Author: Kyra

Low, Finance Team Leader

Attachments: 1. Investment

schedule ⇩

2. Eriksens

Global update 31 March 2023 ⇩

3. Eriksen's

Global investment recommendation ⇩